Should You Trade During A Recession? What Does The Data Say?

Many traders fear a bear market would be really bad for their trading. Is this true? Should you trade during a recession? What does the data say?

There are ways to exploit a bear market during a recession. A big part of that is understanding how the market behaves.

We have in multiple other articles covered bear markets, and some of these are linked below.

The data say you should continue trading during a recession. As a matter of fact, your trading could actually improve!

We have already covered the statistics for a bear market in detail in an article called the anatomy of a bear market. In that article, we made some interesting observations:

- Volatility picks up (which is good for traders)

- Trading the long side tends to improve (counterintuitively)

- The short side also improves

All in all, a trader should be happy for a bear market! We strongly advice to read the linked article above about the anatomy of a bear market.

Backtesting a recession and bear market

Let’s do the following backtest:

In the following example, we use our monthly trading edge for August 2021 (ATR swing trade) as an example. We backtest SPY from its inception in 1993.

Trading Rules

[am4show have=’p2;p3;p58;p59;p130;p138;’ user_error=’Premium Post Access’ guest_error=’Premium Posts’]

We test the ATR strategy both in a bear and a bull market.

What are a bear and bull market? To make it simple we use the 200-day moving average to separate a bear and bull market:

When the close is above the 200-day moving average, we have a bull market.

When the close is below the 200-day moving average, we have a bear market (recession).

Perhaps the latter is technically more of a bear market than a recession, but we still use this moving average to differentiate.

[/am4show]

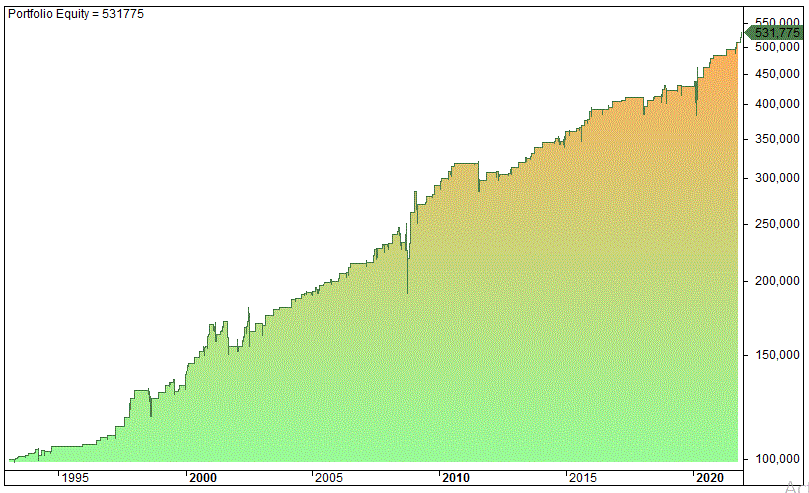

Let’s first see how the strategy performs in its original form no matter bear or bull market:

- #trades: 169

- Average gain per trade: 1.07%

- Win rate: 82%

- Max drawdown: 24%

- Profit factor: 3.0

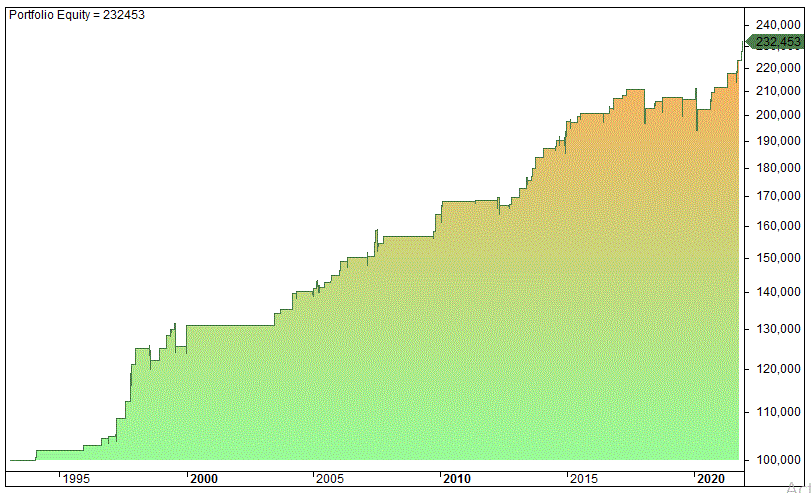

Let’s add our 200-day moving average filter and take trades only when the close is above the average:

- #trades: 81

- Average gain per trade: 1.06%

- Win rate: 85%

- Max drawdown: 8%

- Profit factor: 4.8

The results are pretty good! The win rate is exceptionally high.

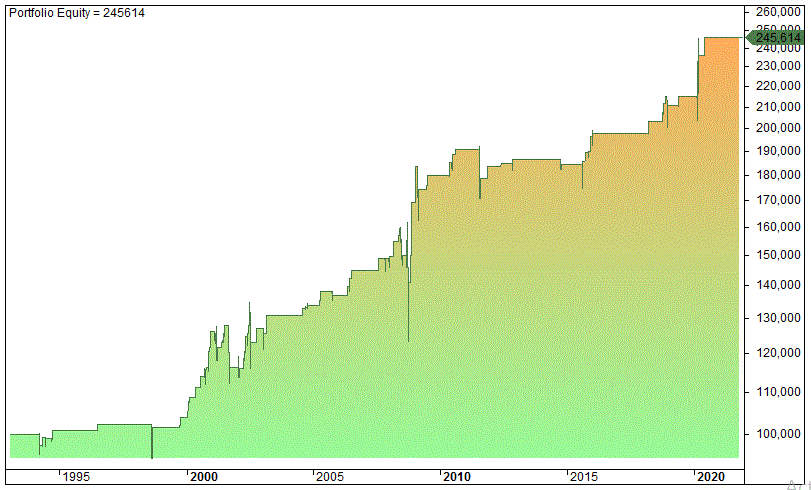

What happens if we only take trade during a recession and a bear market?

- #trades: 88

- Average gain per trade: 1.08%

- Win rate: 78%

- Max drawdown: 24%

- Profit factor: 2.4

It’s still pretty good! The average gain per trade increases, but the win rate is somewhat lower and the profit factor drops. However, it’s stupid not to trade when the S&P 500 is below its 200-day moving average.

All in all, you should trade during a recession.