The Greatest Gold Stock Trading System: Analysis and Outcomes

Almost ten years ago, we traded (for a few months) and revealed a potentially profitable trading strategy for gold miners. The strategy was based on the ETF with the ticker code GDX.

How has the strategy performed since we revealed it? Pretty bad!

First strategy – long trades:

The trading rules in plain English read like this:

Trading Rules

[am4show have=’p2;p3;p58;p59;p130;p138;’ user_error=’Premium Post Access’ guest_error=’Premium Posts’]

- If GDX (Gold stocks (Gold Miners)) rises from the open to the close by more than 0.1%, buy on the close and exit on the opening the next day.

This is the code in Amibroker:

setOption("holdminbars",1);

Buy= ((close-open)/open) > 0.001;

buyPrice= Close;

Sell= Close>0; //force exit

sellPrice= Open ;[/am4show]

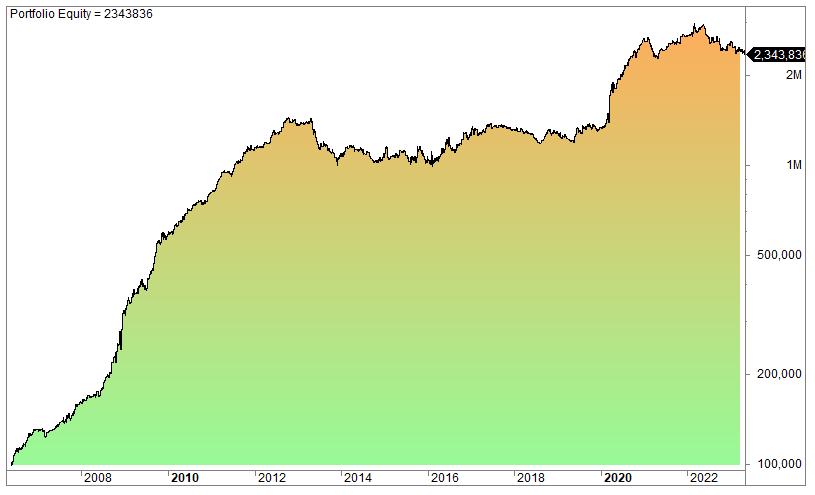

The performance has been like this:

We published the article around 2013, so it has not performed well since then.

Second strategy – short trades:

The trading rules in plain English read like this:

[am4show have=’p2;p3;p58;p59;p130;p138;’ user_error=’Premium Post Access’ guest_error=’Premium Posts’]

- If GDX (Gold stocks (Gold Miners)) rises from the open to the close by more than 0.1% the day before, sell short on the opening and exit on the close (you have to both sell your position from number 1 but also short some more).

This is the code in Amibroker:

setOption("holdminbars",1);

short= ((Ref(C,-1)-Ref(O,-1))/Ref(O,-1)) > 0.001;

shortPrice= O;

Cover= c>0; //force exit

coverPrice= C ;[/am4show]

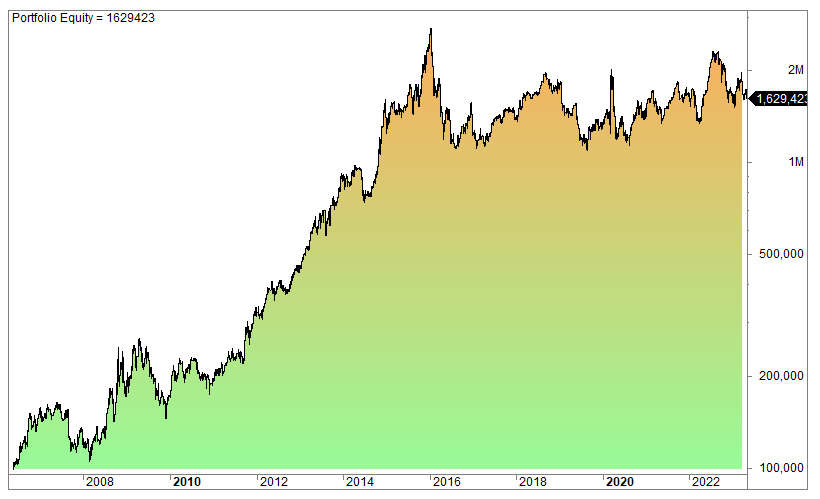

The performance has been like this:

Again, not well since then.

What are the key takeaways and lessons from this?

First, randomness is more prevalent than you’d like to believe.

Second, GDX and commodities are very hard to trade. We believe this is the main takeaway from this. Stocks are great to trade, but any stock related to the commodity business is much more challenging to trade.

Because of this, we are reluctant to provide GDX trading systems as one of our monthly edges. Any strategy in commodities is more likely to fail in the future.

Disclaimer

Quantified Strategies (SIA Lofjord) is not an investment advisor. The content and information provided are educational and should not be treated as financial advisory services or investment advice. Trading and investment in securities involve substantial risk of loss and is not recommended for anyone that is not a trained trader or investor – it shall be conducted at your own risk. It is recommended that you never risk more than you are willing to lose. Leverage can lead to substantial losses. Any use of leverage, margin, or shorting is at your discretion. Quantified Strategies (SIA Lofjord) is not responsible for any losses that occur as a result of its content and information.

Hypothetical or simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, Since the trades have not been executed, the results may have under or overcompensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs, in general, are also subject to the fact that they are designed with the benefit of hindsight. No representations are made that any account will or is likely to achieve profit or losses similar to those shown.