The Shocking Impact of Missing a Few Days in the Stock Market: A Comprehensive Analysis

Market timing is not easy, and if you get it wrong, it might lead to poor compounding (in the long run).

[am4show have=’p2;p3;p58;p59;p130;p138;’ user_error=’Premium Post Access’ guest_error=’Premium Posts’]

We did a backtest to show what happens when you:

- Miss the ten best days

- Miss the ten worst days

One backtest removed the ten best days from 1960 until today for S&P 500 (replaced with zero performance that day), and the other test removed the ten worst days of the dataset. Remember that this is ten days of 15 577 days – 0.064%.

Let’s first check the annual result of buy and hold over the whole period:

10 000 invested in 1960 was worth 782 000 at the end of October 2021.

If we remove the ten best days, the value of the investment drops to 350 000. If we do the opposite and remove the ten worst days, the portfolio value increases to 2.24 million.

Quite a difference!

Why? Because when you miss the best days, you lose the compounding effect.

[/am4show]

The annual returns, the CAGR, are like this:

- Buy and hold: 7.4% (no dividend reinvestment)

- Remove the ten best days: 6%

- Remove the ten worst days: 9.3%

Even small changes in the annual returns lead to wildly different results in your retirement fund. This is an advantage to buy and hold in the battle between buy and hold vs. market timing.

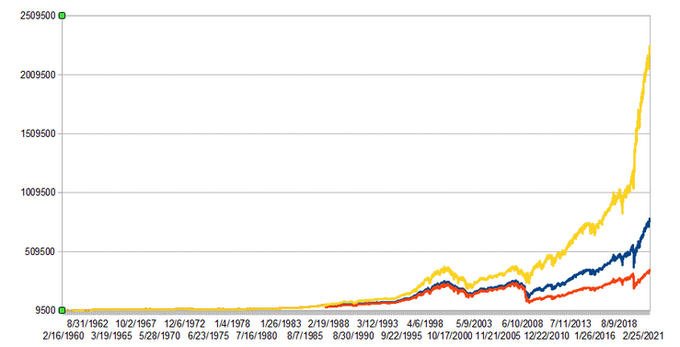

If we look at the graph, the differences are even starker:

The graph above uses a linear scale and shows buy and hold (blue line), missing the ten best days (red line), and avoiding the ten worst days (yellow line).

FAQ:

What is market timing, and why is it challenging?

Market timing refers to the strategy of trying to predict the future movements of financial markets to make buy or sell decisions. It is challenging because it requires accurate predictions, which are notoriously difficult due to the dynamic and unpredictable nature of financial markets.

Why is getting market timing wrong detrimental in the long run?

Getting market timing wrong can be detrimental in the long run because it may lead to poor compounding. Compounding relies on the principle of earning returns on both the initial investment and the accumulated returns over time. Missing the optimal entry or exit points in the market can disrupt this compounding effect.

What happens when you miss the ten worst days in the market?

Missing the ten worst days in the market, as shown in the backtest, can lead to a significant improvement in investment performance. This scenario highlights how avoiding major market downturns can protect the portfolio from substantial losses. However, it’s essential to consider the difficulty of consistently predicting and avoiding such downturns in real-time.