Turn Of The Month – August/September(Insights)

One of the strongest seasonal anomalies in the stock market is the end-of-month effect.

Let’s have a look at how it performs in August/September:

The trading rules for the strategy are like this:

Trading Rules

[am4show have=’p2;p3;p58;p59;p130;p138;’ user_error=’Premium Post Access’ guest_error=’Premium Posts’]

We go long at the close on the fifth last trading day of the month and exit after seven days, ie, at the close of the third trading day of the next month. Thus, the strategy is invested around 33% of the time.

[/am4show]

The performance for each month looks like this for S&P 500 since 1960:

The first column shows each month. For example, the last row (12) shows the performance from the last 5th trading day of the year and the first three trading days of the new year.

[/am4show]

The worst month, by far, is August/September (0.02%).

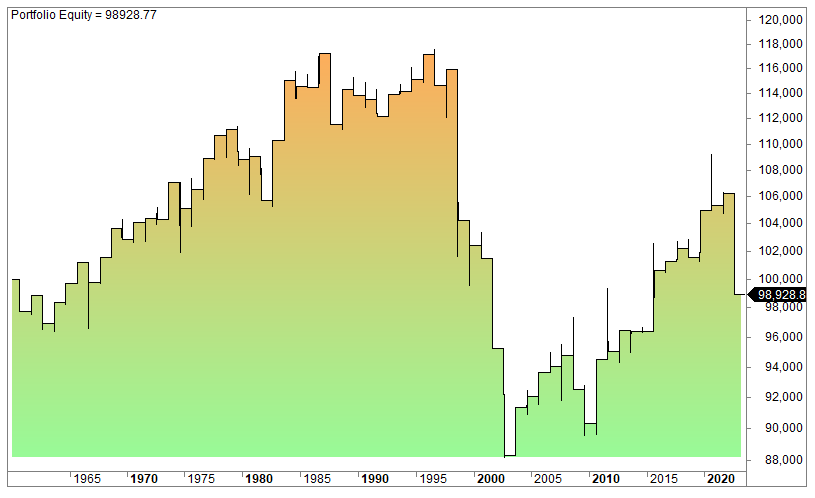

The equity curve looks like this:

Disclaimer

Quantified Strategies (SIA Lofjord) is not an investment advisor. The content and information provided are educational and should not be treated as financial advisory services or investment advice. Trading and investment in securities involve substantial risk of loss and is not recommended for anyone that is not a trained trader or investor – it shall be conducted at your own risk. It is recommended that you never risk more than you are willing to lose. Leverage can lead to substantial losses. Any use of leverage, margin, or shorting is at your discretion. Quantified Strategies (SIA Lofjord) is not responsible for any losses that occur as a result of its content and information.

Hypothetical or simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, Since the trades have not been executed, the results may have under or overcompensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs, in general, are also subject to the fact that they are designed with the benefit of hindsight. No representations are made that any account will or is likely to achieve profit or losses similar to those shown.

FAQ:

What is the significance of “Turn of the Month – August/September”?

“Turn of the Month – August/September” refers to a specific market phenomenon or strategy that takes place during the transition from August to September. It involves analyzing market behavior or trends during this period.

Why is the “Turn of the Month – August/September” important in financial markets?

The “Turn of the Month” is often considered a critical period for traders and investors. August transitioning into September may bring about unique market dynamics, presenting opportunities or challenges.

How can investors prepare for the “Turn of the Month – August/September”?

Investors can prepare for this period by staying informed about economic news, monitoring market indicators, and reviewing historical data. Having a well-thought-out strategy can help navigate potential market fluctuations.