Day of The Week – Does It Matter If It’s a Bull Or Bear Market? (Member Article)

Most readers of this website have probably heard about the Turnaround Tuesday effect in the stock market.

But does the day of the week matter if it’s a bull or bear market?

Let’s look at how the different days of the week perform in bull or bear markets.

Trading rules

[am4show have=’p2;p3;p58;p59;p130;p138;’ user_error=’Premium Post Access’ guest_error=’Premium Posts’]

What’s a bull or bear market? We use the 200-day moving average to filter for bull or bear markets.

Let’s backtest SPY since its inception and find out if the market regime matters:

- We enter at the close of weekday 1-5 (1 is Monday), and

- We exit at the close the after.

[/am4show]

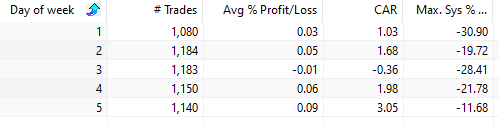

The table below shows the results of a bull market:

Row one shows the results of buying at the close of a Monday and selling at the close of a Tuesday.

That means Mondays are best in a bull market (number 5 – 0.09% gains).

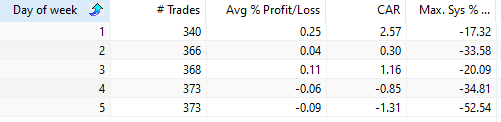

The table below shows the results of a bear market:

In a bear market, we see that Fridays and Mondays are the worst, while Tuesdays are good (and hence the Turnaround Tuesday effect).

Is the weak performance from Thursday until Tuesday tradable (as a short)? Let’s look at the performance of buying the close of Thursday in a bear market and sell on Monday’s close:

The pattern is not that consistent, but the 373 trades from inception until today might work if changing the trading rules or adding one or two variables.