Daily Trading Edge #40

Instrument/asset

S&P 500 (SPY)

Trading rules

The trading rules of the edge read like this (please also backtest yourself – you might find a way to improve it):

- Today’s close is an FOMC meeting day.

Results

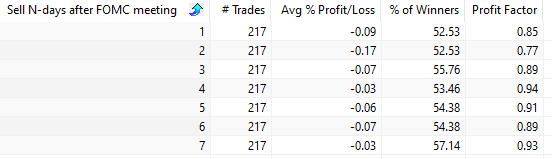

Trading performance if exit after N-days:

The edge is negative, perhaps with a short trade.

Improved Trading Edge

As you can see from the above table, performance is weak overall after a FED meeting.

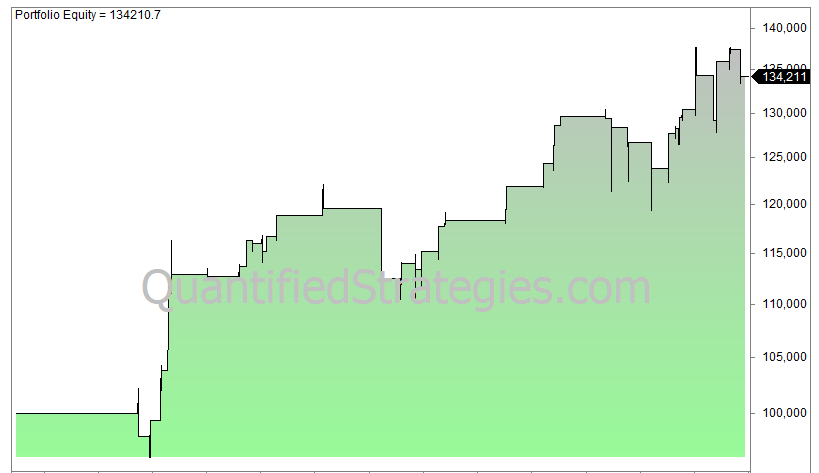

If the day of the FED meeting SPY rises at least 0.75% compared to yesterday’s closing price, we get the following equity curve:

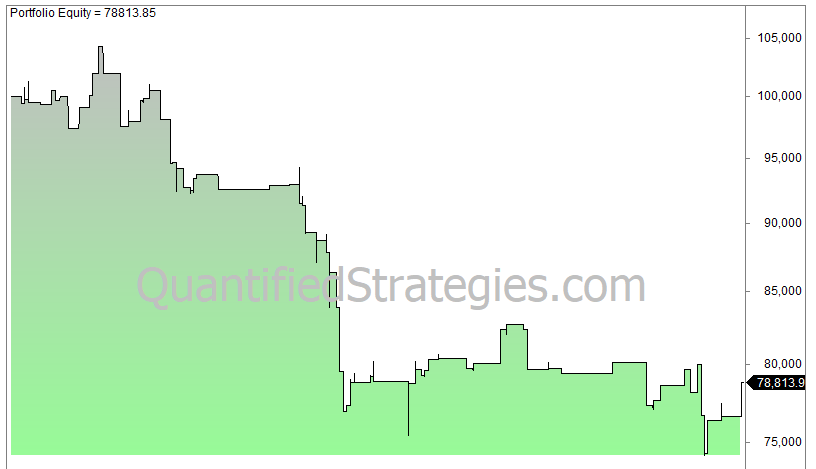

The average is a negative 0.33% per trade (69 trades), and might indicate a potential short trade.

Opposite, when the close is down two days in a row on the FED day, the edge turns very positive (below is the equity curve when exiting 6 days later):