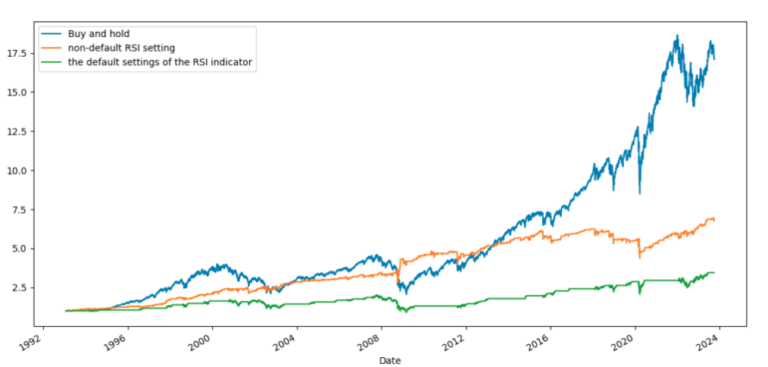

RSI 14 Debunked – Do This Instead (Statistics, Numbers, Facts)

The Relative Strength Indicator, abbreviated RSI, is probably the most popular trading indicator. It’s mentioned in almost endless posts and articles on the internet. To our knowledge, the standard default setting of 14 days is mostly used. But does the default setting of 14 days work? Can we debunk this setting as faulty? Let’s find…