The Turn Of The Month Trading Strategy (End Of Month – Video, Setup, Rules, Python Code)

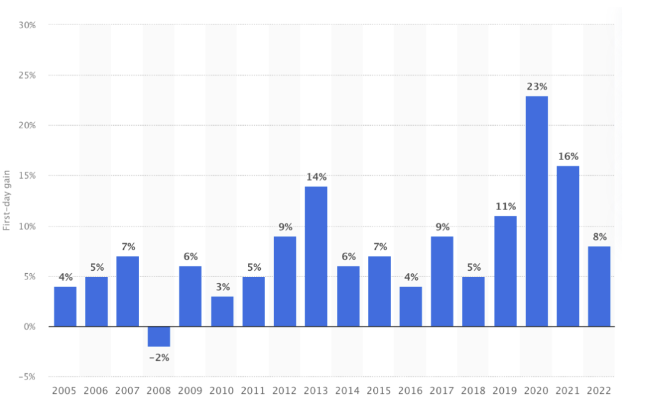

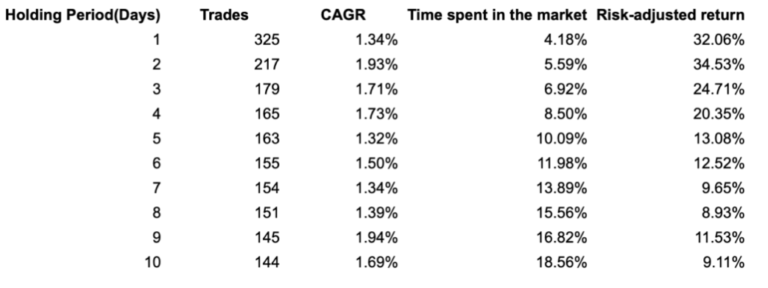

The end-of-month effect is a well-known trading strategy in the stock market. We have covered this anomaly before. Perhaps what is lesser known is that the effect spills over to the first three days of the next month. Thus, a more correct name might be the turn of the month strategy (or turn of the…