Monday/Tuesday In Nasdaq Trading Strategy

Previously we have written about the Turnaround Tuesday Strategy and the Monday/Tuesday trade strategy in Nasdaq (QQQ). How has this strategy performed lately?

Pretty good. I’ve been trading this strategy, with these trading rules:

Trading Rules

[am4show have=’p2;p3;p58;p59;p130;p138;’ user_error=’Premium Post Access’ guest_error=’Premium Posts’]

- Today is either Monday or Tuesday.

- Internal Bar Strength (IBS) is 0.15 or below.

- If both criteria 1 and 2 are fulfilled, go long QQQ at the close.

- Exit at close if today’s close is higher than the close of yesterday.

[/am4show]

This is all there is to it. In the previous article, the exit criteria were when higher than yesterday’s high, but to lower the risk of being “stuck” I lowered the exit to when the close is higher than the close of yesterday.

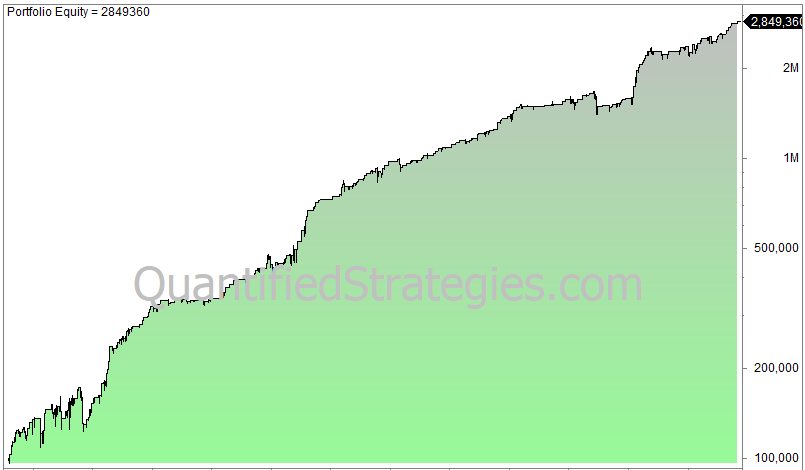

This strategy has performed well since the year 2000, and the equity chart from 2010 is like below, assuming a 100% allocating of equity to this strategy. This is the equity curve:

FAQ:

– What is the Turnaround Tuesday Strategy in Nasdaq (QQQ)?

The Turnaround Tuesday Strategy is a trading approach applied to the Nasdaq (QQQ) that focuses on specific criteria for entering and exiting trades on either Monday or Tuesday.

– What are the trading parameters for the Turnaround Tuesday Strategy?

The trading parameters for this strategy include checking if it’s either Monday or Tuesday and assessing the Internal Bar Strength (IBS), which should be at or below 0.15. If both criteria are met, traders go long on QQQ at the closing price.

– What is the performance data for this trading strategy since the year 2000?

Since the year 2000, the Turnaround Tuesday Strategy has demonstrated strong performance. In the provided example, with a 100% allocation to the strategy, there were 111 trades, an average gain of 1.16%, a win-ratio of 76%, and a maximum drawdown of 5.7%.

In this strategy today close is not higher than yesterday close. Where is my stoploss?

Hi, I never use stops in my strategies. I use size for management purposes.