Nasdaq (QQQ) Mean Reversion (Trading Strategy Analysis)

Below is a simple and easy trading strategy to implement in QQQ.

Let’s go straight to the trading rules:

Trading Rules

[am4show have=’p2;p3;p58;p59;p130;p138;’ user_error=’Premium Post Access’ guest_error=’Premium Posts’]

- IBS (internal bar strength) must be lower than 0.25.

- RSI (5) must be below 25.

- If 1 and 2 are fulfilled, go long at the close.

- Exit when close is higher than yesterday’s high (you can use higher than yesterday’s close as well – it has shorter holding periods and less drawdown).

[/am4show]

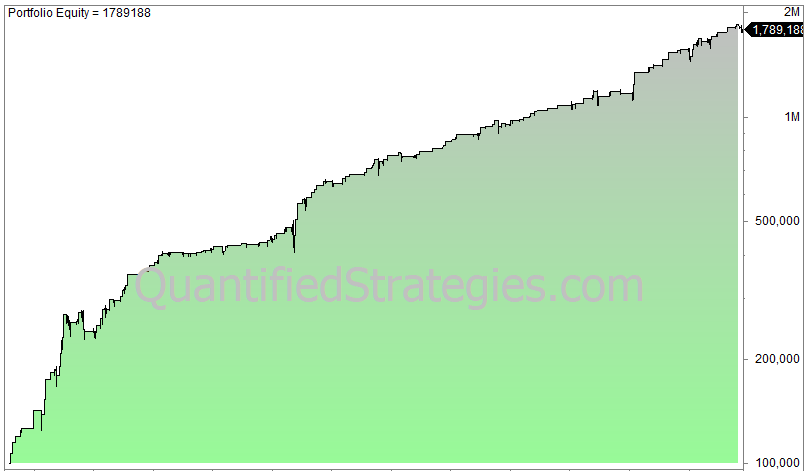

The equity curve since January 2000 looks like this (starting with 100 000 in equity and allocating 100% of equity to every trade, ie. compounding, but taxes are not deducted):

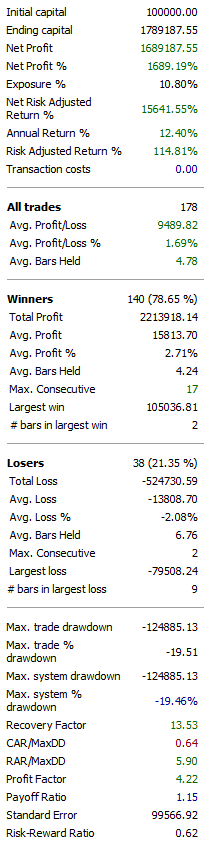

Worth noting is that the profit factor is very high, drawdown is much less than buy and hold and CAGR of 12.4% is substantially above buy and hold’s 9% (including reinvested dividends):

Basically, any mean reversion has worked for QQQ. Will it hold up in the future? No one knows.

FAQ:

– When should you exit a trade in this QQQ trading strategy?

To exit the trade, you should wait for the close to be higher than yesterday’s high or, alternatively, higher than yesterday’s close.

– How has this QQQ mean reversion trading strategy performed since January 2000?

The equity curve, starting with $100,000 and compounding without deducting taxes, has shown significant returns. The strategy has performed well in both bull and bear markets, with a high profit factor, minimal drawdown, and a Compound Annual Growth Rate (CAGR) of 12.34%.

– Is mean reversion a reliable strategy for QQQ, and will it continue to be successful in the future?

Mean reversion has historically worked well for QQQ, but the content emphasizes that the future is uncertain, and no one can predict with certainty whether this strategy will remain effective.

How do you determine IBS

(c-l)/(h-l)

where is stoploss in this strategy? and whatif gap down happen on next day?

There is no stop-loss. The strategy is nothing more than what is written in the article. You might want to trade it another way, and that is fine. This is just an idea (for free).