Post-OPEX Week In August – Performance And Returns for Stocks, Bonds, And Gold Explained

How have stocks, bonds, and gold performed after options expiration week in August?

Let’s backtest and find out:

Trading Rules

[am4show have=’p2;p3;p58;p59;p130;p138;’ user_error=’Premium Post Access’ guest_error=’Premium Posts’]

Trading rules:

- Entry at the close of the OPEX day;

- Exit next Friday or after five days.

Amibroker code:

Buy= DayOfWeek()==5 AND Day()>14 AND Day()<22 AND Month()==8 ;

buyPrice=Close;

Sell= DayOfWeek()==5;

sellPrice=Close ;

applyStop(stopTypeNBar,stopModeBars,5,1) ;[/am4show]

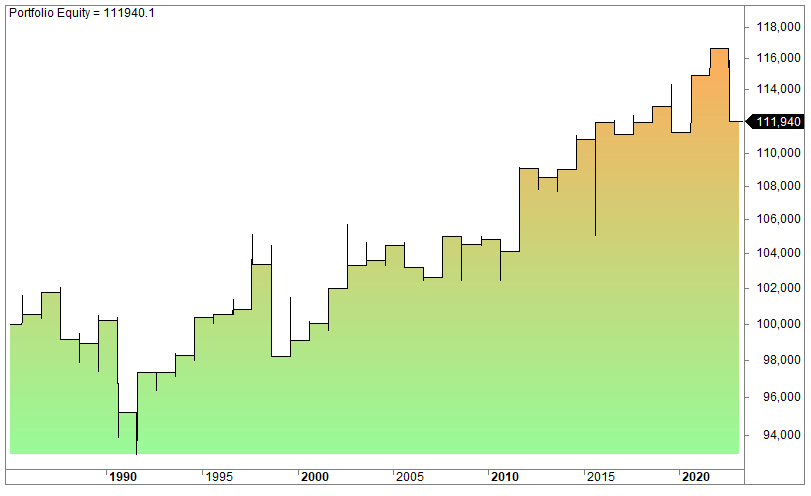

First, let’s backtest the performance of stocks (S&P 500) since 1985. We chose 1985 because it was around this time that derivatives started attracting interest and trading:

The average gain per trade is 0.32%, which is slightly above average for any random week.

What about gold?

It’s been a pretty erratic ride:

The average gain is a negative 0.14%.

Bonds

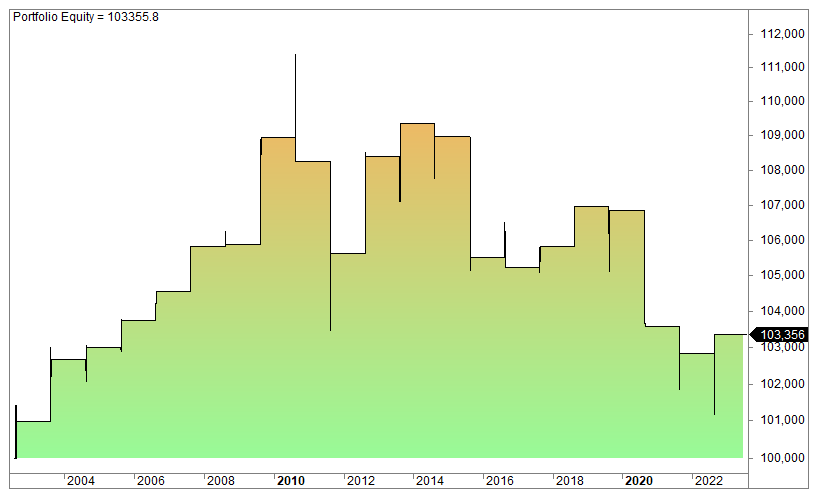

Since 2002 TLT (the ETF for long-term Treasury bonds) has performed like this:

The average gain per trade is 0.17%, but, as you can see, pretty erratic.

Disclaimer

Quantified Strategies (SIA Lofjord) is not an investment advisor. The content and information provided are educational and should not be treated as financial advisory services or investment advice. Trading and investment in securities involve substantial risk of loss and is not recommended for anyone that is not a trained trader or investor – it shall be conducted at your own risk. It is recommended that you never risk more than you are willing to lose. Leverage can lead to substantial losses. Any use of leverage, margin, or shorting is at your discretion. Quantified Strategies (SIA Lofjord) is not responsible for any losses that occur as a result of its content and information.

Hypothetical or simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, Since the trades have not been executed, the results may have under or overcompensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs, in general, are also subject to the fact that they are designed with the benefit of hindsight. No representations are made that any account will or is likely to achieve profit or losses similar to those shown.

FAQ:

What is the significance of the “Post-OPEX Week” in August?

The Post-OPEX Week in August refers to the week following options expiration (OPEX) in August. Traders often analyze this period for potential market trends and shifts. The Post-OPEX Week in August is considered noteworthy due to historical patterns and potential market movements that may occur during this period.

How is the performance of stocks evaluated during the Post-OPEX Week?

The performance analysis covers stocks, bonds, and gold, providing insights into how these different asset classes perform during the Post-OPEX Week in August. The performance of stocks is assessed based on historical data, considering factors such as price movements, trends, and volatility during the specified week.

How can investors use the information on Post-OPEX Week performance?

Investors can use the insights gained from the analysis to make informed decisions about their portfolios, considering potential trends and market dynamics. The analysis evaluates the historical performance of gold during the Post-OPEX Week, exploring whether it tends to act as a safe-haven asset during this period.