Retail Stocks Trading Strategies – (Seasonalities, Setups and Backtest Analysis)

A few months back we published an article about seasonality in the retail sector:

Our article was based on research done by Jay Kaeppel. Mr. Kaeppel did a follow up some few months later, but this time he included two slightly different retail funds by fidelity:

- FDFAX: Fidelity Select Consumer Staples (Kaeppel writes these are stocks that make products consumers “have to buy”)

- FSRPX: Fidelity Select Retailing (stocks that produce goods consumers “want to buy”)

The biggest holdings of FDFAX are these:

- Procter & Gamble Co (PG) 16.99%

- Coca-Cola Co (KO) 13.95%

- Mondelez International Inc Class A (MDLZ) 7.59%

- PepsiCo Inc (PEP) 7.53%

- Walmart Inc (WMT) 5.61%

The biggest holdings of FSRPX are these:

- Amazon.com Inc (AMZN) 18.62%

- The Home Depot Inc (HD) 10.31%

- Lowe’s Companies Inc LOW (5.85%)

- Target Corp (TGT) 4.69%

- Dollar General Corp (DG) 3.47%

Can you spot the differences in the composition? It might not be obvious, but we believe Jay Kaeppel is on to something. His point is that the FDFAX owns stocks that gravitate towards products that we “must” consume in our everyday life, while FSRPX has companies that make goods we don’t necessarily need, but that we “want”.

No matter what, the hypothesis to Kaeppel is this:

[am4show have=’p2;p3;p58;p59;p130;p138;’ user_error=’Premium Post Access’ guest_error=’Premium Posts’]

For our purposes we will hold:

*FDFAX from May 1st through October 31st

*FSRPX from November 1st through April 30th

We test the following retail stock seasonality:

We use daily data downloaded from Yahoo!finance from 1986 until June 2021.

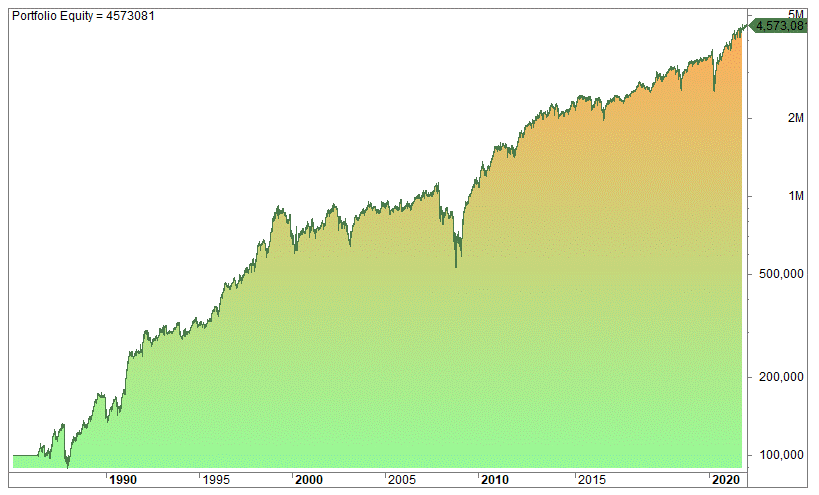

Let’s test a portfolio where we are long FDFAX from May through October, and long FSRPX from November through April:

[/am4show]

The CAGR is 11% and the biggest drawdown is 53% in 2008/09. Mind you, the return is 1% higher than holding the S&P 500 over the same period.

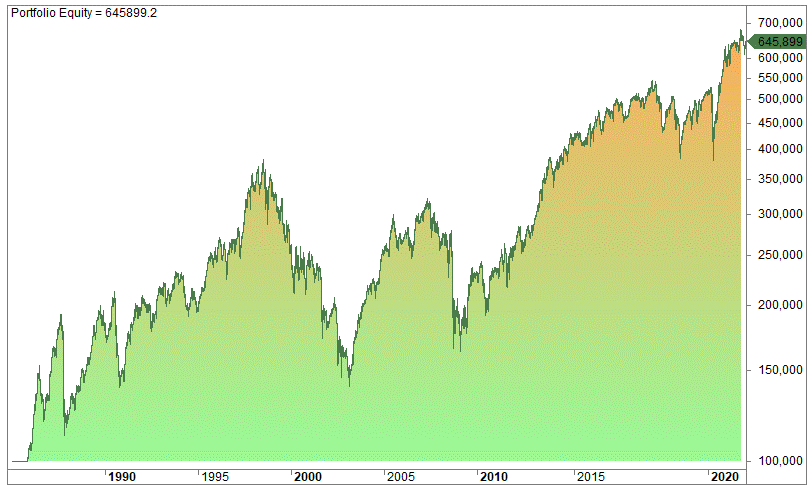

What happens if we do the opposite, ie. flip the seasonality?

The CAGR drops to 5.2% and the drawdown increases to 63%.

Amibroker code for seasonalities:

We used Amibroker to test the strategies. This is a program that is superb for both backtesting and live trading. It’s highly customizable. Look at our review done a few years back:

You can get the Amibroker code for the tests done in this article on this link:

Disclosure: We are not financial advisors. Please do your own due diligence and investment research or consult a financial professional. All articles are our opinions – they are not suggestions to buy or sell any securities.

FAQ:

Who is Jay Kaeppel, and what research did he contribute to the understanding of retail seasonality?

Jay Kaeppel is a researcher known for his work in financial markets. He conducted research on retail seasonality, focusing on two Fidelity funds: FDFAX (stocks consumers “have to buy”) and FSRPX (stocks consumers “want to buy”). His work delves into the composition and performance of these funds based on consumer needs and desires.

What are the main differences in the composition of FDFAX and FSRPX?

FDFAX holds stocks related to products consumers “have to buy,” including major companies like Procter & Gamble and Coca-Cola. FSRPX, on the other hand, consists of companies making goods consumers “want to buy,” with prominent holdings such as Amazon.com and The Home Depot.

How does the trading strategy based on seasonality work for FDFAX and FSRPX?

The strategy involves holding FDFAX from May 1st through October 31st and FSRPX from November 1st through April 30th. This approach is designed to align with consumer needs and desires during different seasons, potentially optimizing returns based on the characteristics of each fund.