Rotating Monthly Between Stock Indexes and Bonds – Overview

Stock and sector rotation is when you switch between different asset classes or stocks. In this case, between different asset classes.

We did a backtest involving SPY, TLT, and LQD. It’s a strategy backtested by many and in different ways, but we decided to make our own twist to it.

We have previously published several rotation strategies, but we have never tested LQD in the mix.

SPY, TLT, and LQD are the ETFs for S&P 500, 20-year Treasuries, and investment-grade corporate bonds.

What do we mean by rotation in trading?

Stock and sector rotation are when you switch between different asset classes or stocks. In this case, between different asset classes.

Monthly Rotation Between SPY, TLT, And LQD – trading rules

[am4show have=’p2;p3;p58;p59;p130;p138;’ user_error=’Premium Post Access’ guest_error=’Premium Posts’]

We test a strategy that each month picks one of these three ETFs with the highest total return over a certain lookback period:

- SPY

- TLT

- LQD

We test the following hypothesis by using monthly bars:

- At the end of every month, we rank the three ETFs based on each performance over the last 1-12 months.

- We go long the ETF with the best performance over the lookback period in number 1.

- Rinse and repeat every month.

[/am4show]

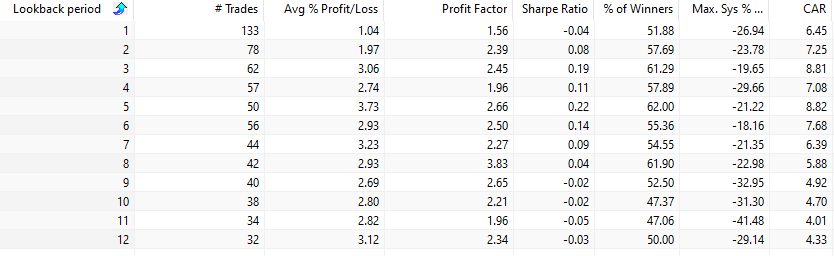

Our optimization of the strategy returns this table:

The best results are by using a lookback period of 3-6 months.

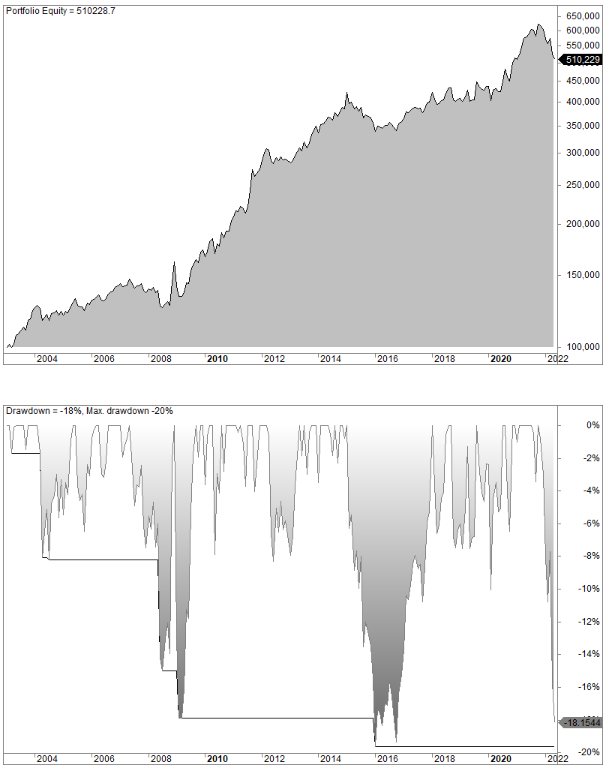

The equity curve for a 3 month lookback period looks like this:

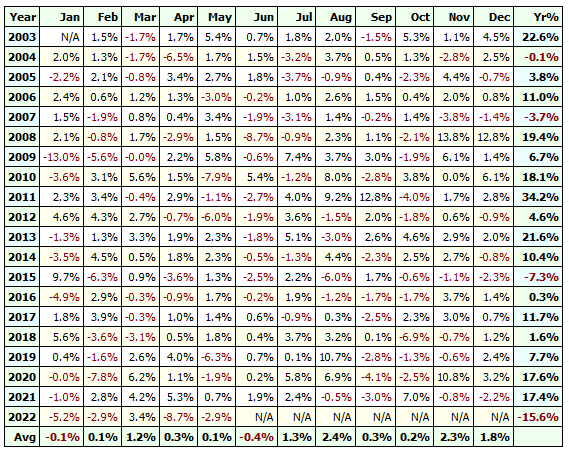

These are the annual returns:

No safe havens.

FAQ:

What is stock and sector rotation in trading?

Stock and sector rotation is a dynamic investment strategy that involves strategically shifting investments between different asset classes or sectors within the market. The primary objective is to capitalize on changing market conditions, economic trends, or business cycles to optimize returns and manage risks effectively.

How is the ranking done in the monthly rotation strategy?

Stock and sector rotation is often employed as a diversification strategy. By spreading investments across various asset classes or sectors, investors aim to reduce the impact of poor performance in any single area. At the end of every month, the three ETFs are ranked based on their performance over the last 1-12 months. The ETF with the best performance over the lookback period is chosen for the next month.

Are there any safe havens mentioned in the backtest results?

Rotation strategies can be a form of risk management. Investors may rotate into assets perceived as less risky during uncertain times and shift towards higher-risk, higher-reward assets when market conditions are favorable. According to the backtest results, there are no identified safe havens. The strategy aims to find the best-performing ETF each month without considering a specific safe haven.