Sector Rotation: S&P 500 and Treasuries Dynamic Shifts

Here is a trading strategy that are rotating between S&P500 and Treasuries.

There exist many strategies that rotate between S&P 500 and Treasuries. Over the weekend we had a look at the white paper of Meb Fabe called A Quantitative Approach to Tactical Asset Allocation.

On page 20, Meb Faber is referring to a long-term investment strategy by Jeremy Siegel. We decided to test Sigel’s approach, but by including long-term Treasuries when the strategy sells S&P 500.

[am4show have=’p2;p3;p58;p59;p130;p138;’ user_error=’Premium Post Access’ guest_error=’Premium Posts’]

Siegel’s strategy is like this:

Jeremy Siegel investigates the use of the 200-day SMA in timing the Dow Jones

Industrial Average (DJIA) from 1886 to 2006. His test bought the DJIA when it closed at least 1 percent above the 200-day moving average, and sold the DJIA and invested in Treasury bills when it closed at least 1 percent below the 200-day moving average.

The strategy slightly improves the result compared to using the 200-day moving average (without any modifications).

We decided to make a twist to the strategy:

When the strategy exits S&P 500, we switch to TLT (long-term Treasuries).

The logic is that TLT offers some kind of safe haven. (This has not worked well so far in 2022 when both asset classes have sold off sharply, though. This proves that the market is always changing.)

[/am4show]

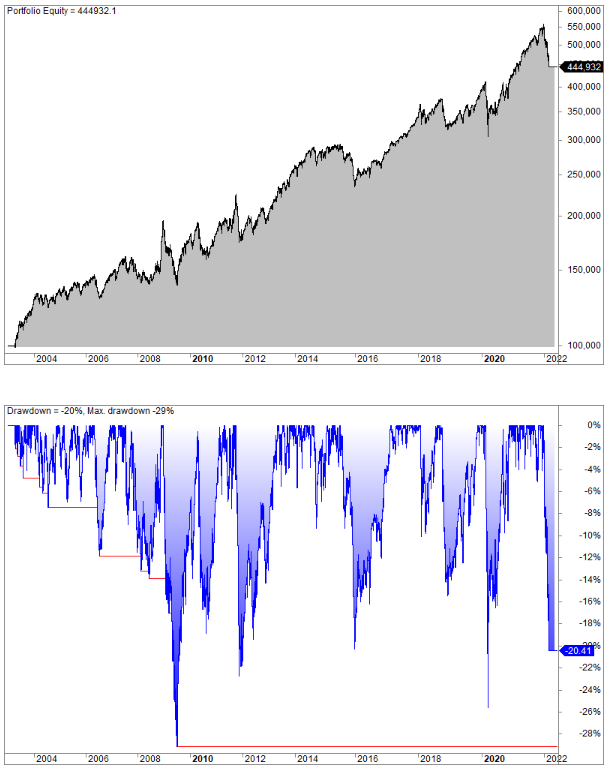

The backtested results show an equity curve like this from 2003:

The CAGR is 7.75 but has a significantly lower drawdown compared to buy and hold.

If you don’t know how to backtest such a strategy, we have shown how in both our Amibroker course and in our other product where we have trading code for over 100 different trading ideas.

FAQ:

What is the rationale behind rotating between S&P 500 and long-term Treasuries?

The strategy of rotating between S&P 500 and long-term Treasuries aims to capitalize on different market conditions and provide a risk-mitigating approach. When the strategy exits S&P 500, it shifts to long-term Treasuries (TLT) as a strategic move to potentially safeguard investments during periods of market uncertainty.

How does the strategy determine the timing of exiting S&P 500 and entering long-term Treasuries?

The strategy utilizes a modification of Jeremy Siegel’s approach, specifically involving the 200-day Simple Moving Average (SMA) as a timing mechanism. According to the strategy, when the S&P 500 closes at least 1 percent below the 200-day SMA, it triggers the exit from S&P 500. Subsequently, the portfolio transitions into long-term Treasuries. This decision is rooted in technical analysis, where the 200-day SMA serves as a key indicator of the market trend.

Has the effectiveness of rotating to long-term Treasuries been consistent over various market conditions?

The strategy acknowledges that its effectiveness, particularly in terms of the shift to long-term Treasuries, is subject to market dynamics. The content notes a specific instance in 2022 when both S&P 500 and Treasuries experienced sharp selloffs, challenging the conventional belief in the safe-haven nature of Treasuries during such periods. This emphasizes the importance of recognizing that market conditions can vary, and historical performance might not always predict future outcomes.