Mean-Variance Portfolio In Python: A Comprehensive Practical Guide

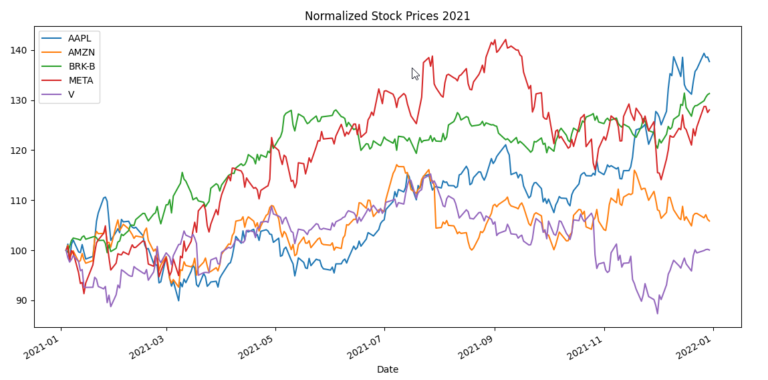

This article explores the implementation of a mean-variance portfolio in Python. It delves into the core concepts of Modern Portfolio Theory in Section 1 and proceeds to provide a practical Python example in Section 2. Modern Portfolio Theory is a significant methodology widely applied in financial investment, focusing on optimizing returns while minimizing risk through…