The Overnight Edge – Assessing Its Current Effectiveness

One of the best edges in the stock market is the overnight edge – the price action from the close until tomorrow’s morning (or close). Is it still working? Can a trend filter improve performance?

Empirical evidence – the overnight edge:

The overnight edge is best illustrated by a simple backtest and a chart.

[am4show have=’p2;p3;p58;p59;p130;p138;’ user_error=’Premium Post Access’ guest_error=’Premium Posts’]

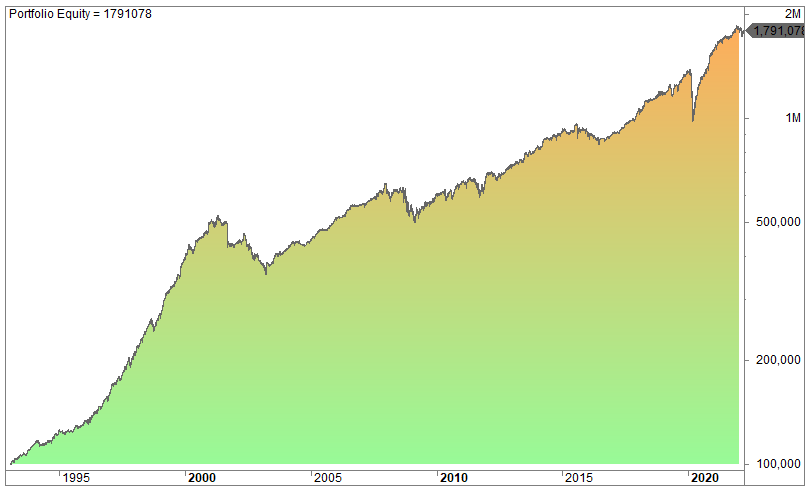

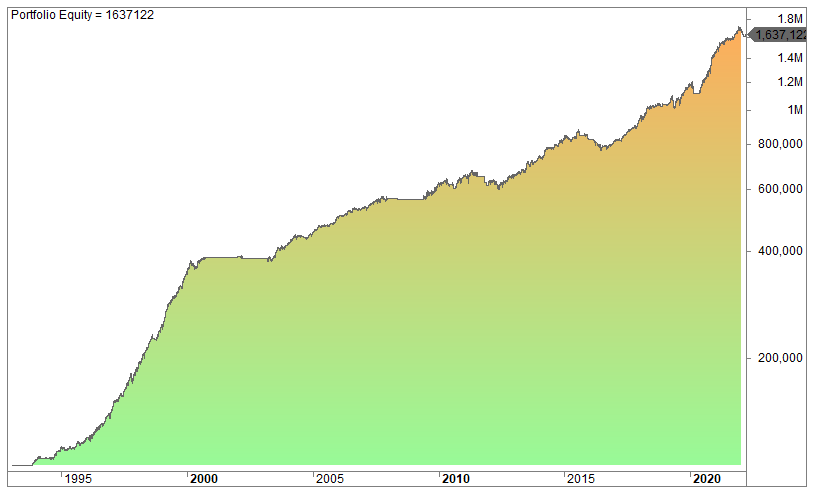

This is the equity curve since 1993 if you bought every close and sold at the open the next day:

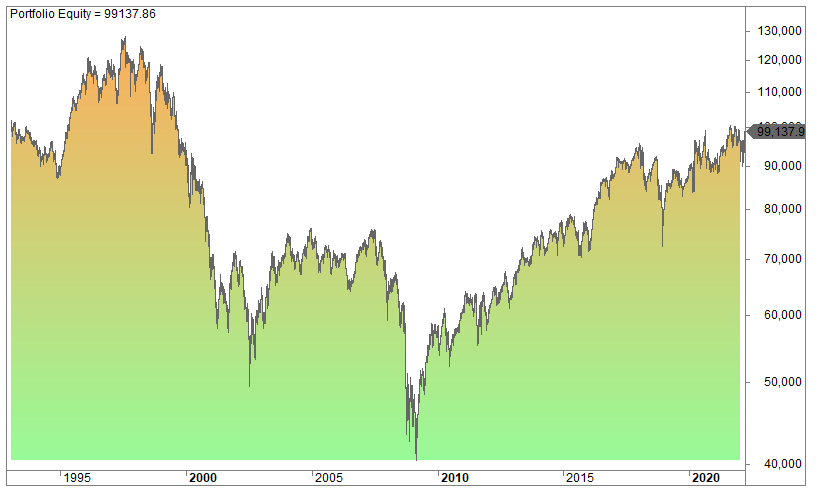

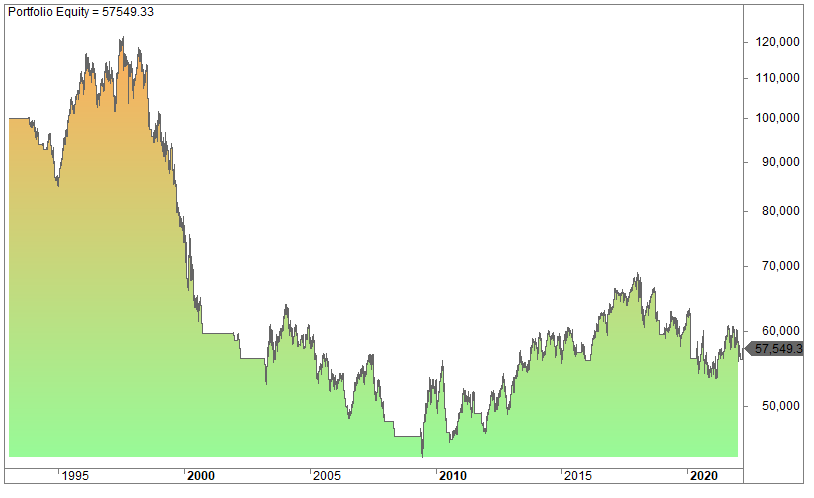

Compare this to if you bought every open and sold at the close the very same day (day trading):

For almost 30 years you would have experienced a small loss if you bought the open and sold at the close.

Thus, all the gains since 1993 have come while the stock market was officially closed!

30 years is a long period. Let’s narrow down and look at the performance since 2020.

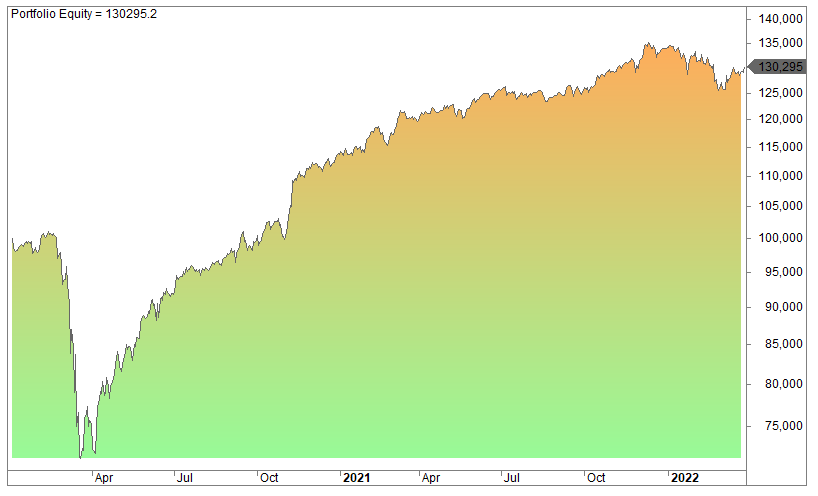

This is the close to the next open:

The Covid-19 mess made a dent in the equity curve but has since performed well. The overnight is no magic bullet but performs poorly in a bear market.

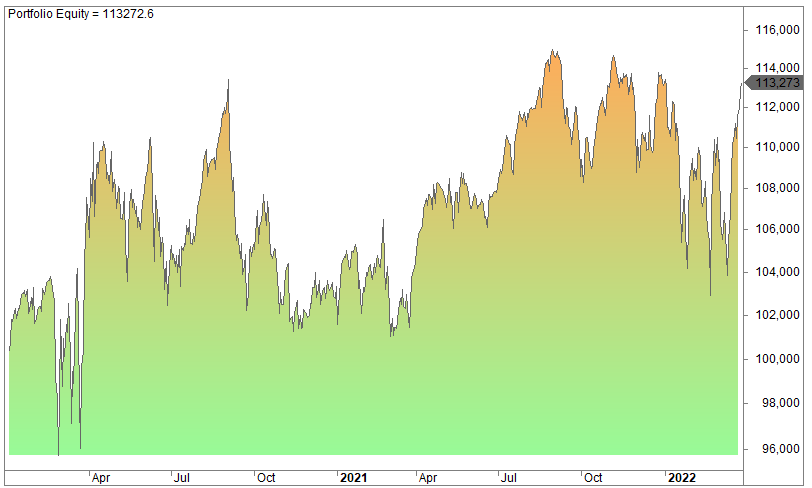

This is from the open to the close:

Inserting a trend filter

If we put in a trend filter, for example a requirement that the close must be above the 200-day moving average, it performs slightly better.

[/am4show]

The chart below shows the performance from the close to the next open (the overnight edge):

The end result is more or less the same while drawdowns and time spent in the market are reduced. Thus, we can argue the risk-adjusted return is improved. Please read our article about trading strategy and system performance metrics.

And this is the day trade from the open to the close:

The day trade performs even poorer in bull markets!

Ending remarks:

As mentioned, the overnight edge is no magic bullet but it’s a great tool to take advantage of in your trading. Day trading is extremely difficult and part of the explanation is shown in the charts above (no tailwind).

FAQ:

What is the overnight edge in the stock market?

The overnight edge refers to the price action that occurs from the market close until the following morning’s open. It is a phenomenon observed in stock market trading, where gains have historically been realized during this specific timeframe.

How is the overnight edge illustrated in the provided content?

The content illustrates the overnight edge through backtested data and charts. It compares the performance of buying at the close and selling at the open the next day against buying at the open and selling at the close on the same day. The charts demonstrate the significant gains associated with the overnight edge.

What does the equity curve since 1993 reveal about the overnight edge?

The equity curve since 1993 shows that buying at the close and selling at the open the next day has resulted in gains, while buying at the open and selling at the close on the same day has led to a small loss. This indicates that a substantial portion of gains in the stock market has occurred during the period when the market is officially closed.