Daily Trading Edge #20

Instrument/asset

S&P 500 (SPY)

Trading rules

The trading rules of the edge read like this (please also backtest yourself – you might find a way to improve it):

- SPY opens at a 20-day high; and

- Ends lower with an IBS reading below 0.25.

Results

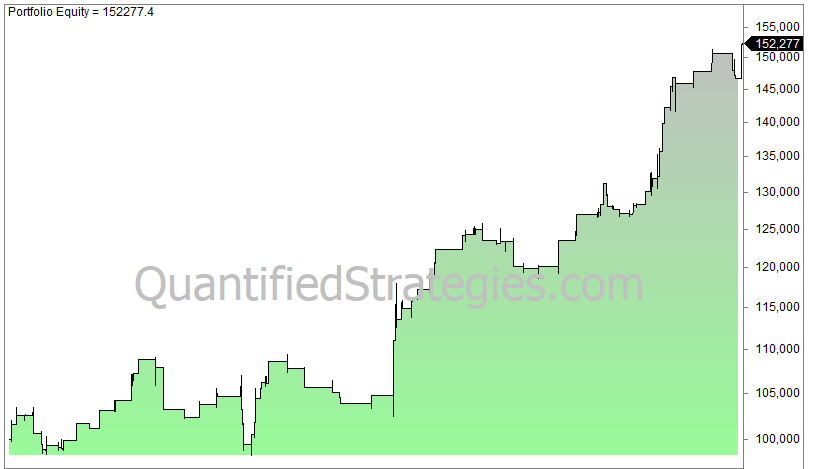

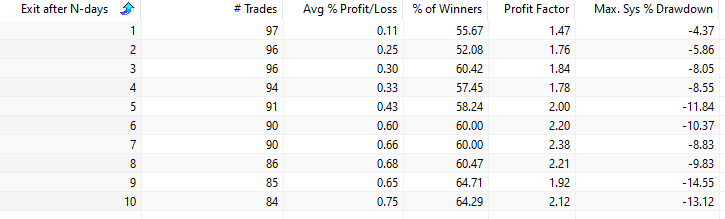

Trading performance if we exit after N-days since SPY’s inception in 1993:

Clearly, this indicates a very positive edge over the coming days.

If you hold for 5 trading days you get the following equity curve:

Improved trading edge

Can it be improved?

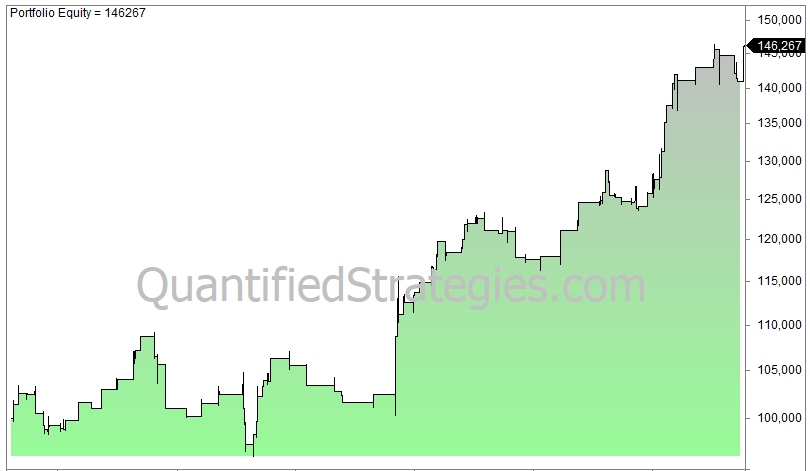

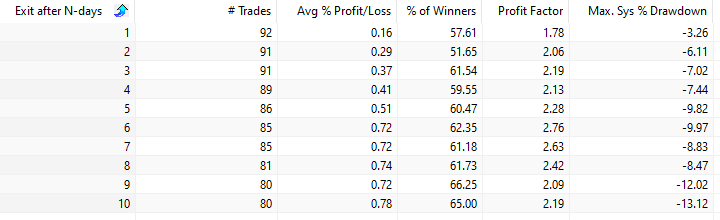

Let’s add interest rates into the mix. We add that TLT must end higher than yesterday’s close, ie. interest rates have dropped (rates and price are inversely correlated):

What happens? The #trades don’t go down that much, but we exclude a few losers: