Daily Trading Edge #39

Instrument/asset

S&P 500 (SPY)

Trading rules

The trading rules of the edge read like this (please also backtest yourself – you might find a way to improve it):

- In N-days, there is a FOMC meeting.

Results

We have backtested the performance of SPY in the days before the meeting ends.

We go long N-days before the meeting ends (the last day of the meeting) and sell at the close of the day of the meeting. The backtest period is from 1997 until today:

The first column shows the statistics when we enter the close N-days before the FOMC meeting.

For example, row 2 shows that we have got a 0.5% return in SPY by owning it for 48 hours. Not bad! Any random two-day period has had 0.08% gains since 1997.

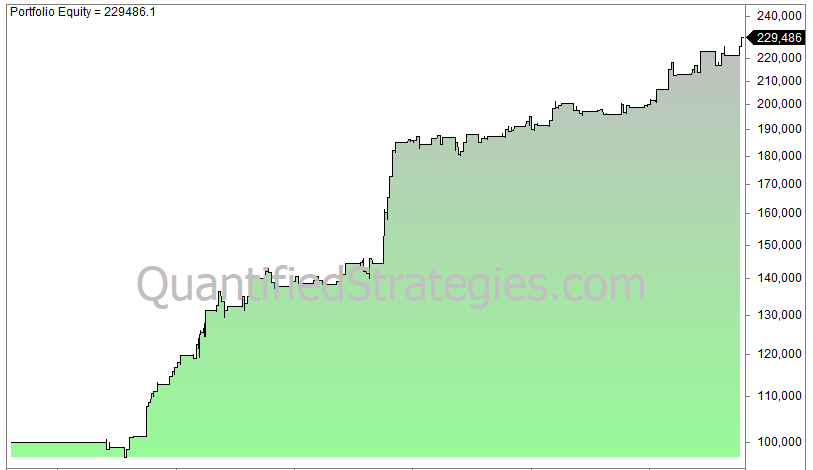

The equity curve looks like this if you enter 2 days before the meeting ends:

Improved results

The results improve when the close is below the 200-day moving average: 0.93% average gains two days before the meeting until the end of the meeting.

Another drag of performance is if the close is at a 10-day high of the close.

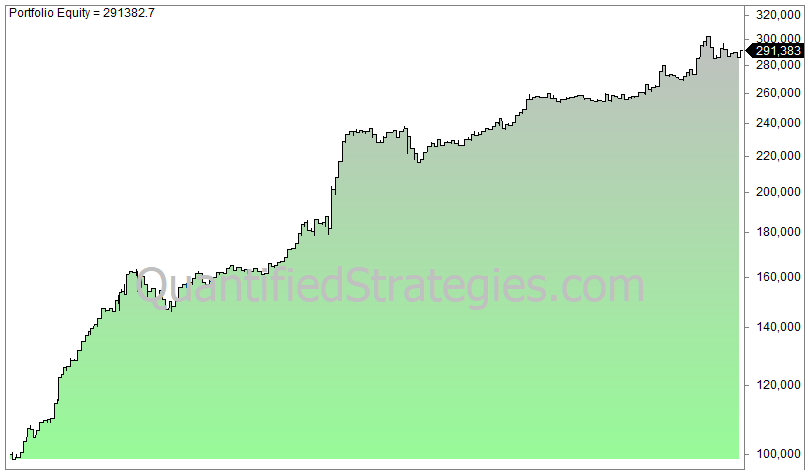

Also, the bearish months from May until September drag down the average. Below is the equity curve if you avoid May, June, July, August, and September (average 0.7%):