Trading Edge #53

Instrument/asset

S&P 500 (SPY)

Trading rules

The trading rules of the edge read like this (please also backtest yourself – you might find a way to improve it):

- Open is higher than yesterday’s open; and

- Open is lower than yesterday’s close; and

- Close is lower than yesterday’s close; and

- Close is lower than yesterday’s open.

Results

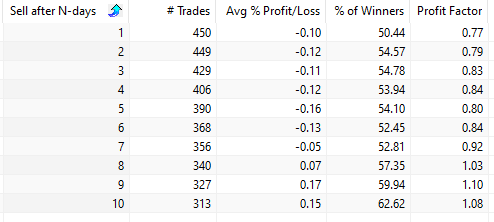

Below is the table if we hold for N days since SPY’s inception in 1993:

Improved edge

Can the negative trading edge be improved, ie making it more negative and turning it into a potentially short strategy?

It turns out Fridays and Thursdays are quite positive, and the first three days of the week are very negative.

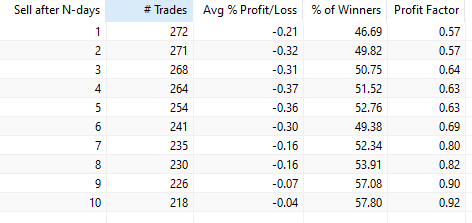

If we exclude signals on Fridays and Thursdays, we get the following data:

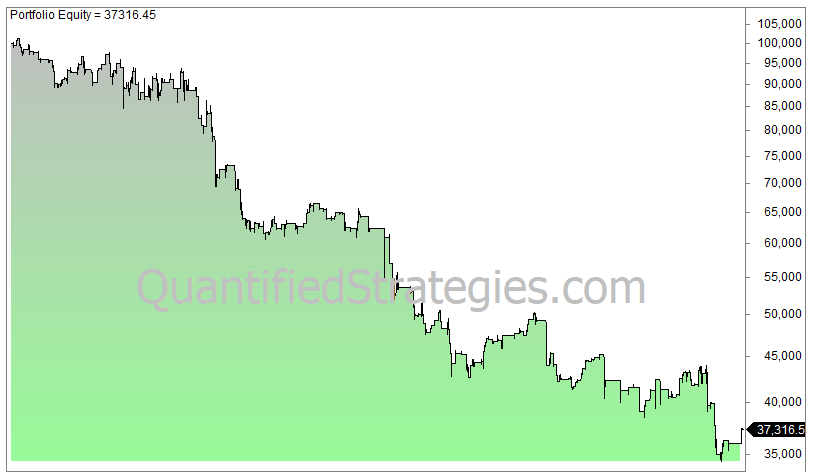

If we exclude Fridays and Thursdays and hold SPY for 5 trading days, we get the following equity curve:

It’s a pretty consistent negative drag and a lot of trades. It has the potential to be turned into a tradeable short strategy.