Turnaround Tuesday In A Bear Market: Strategies for Capitalizing

Let’s test the strategy Turnaround Tuesday but only in bear markets. Does that work?

Turnaround Tuesday is one trading idea that has worked very well for many decades. We have covered it on our website multiple times.

We are now in a bear market. Some asset classes are crashing. As of writing, stocks are down 2-5% and Bitcoin is down a jaw-dropping 25%.

Today is the second day with a huge drop in the market.

Let’s test the following hypothesis on S&P 500 (SPY):

[am4show have=’p2;p3;p58;p59;p130;p138;’ user_error=’Premium Post Access’ guest_error=’Premium Posts’]

- Today is Monday.

- Both today and yesterday (Friday) were down days.

- Today’s close must be below the 200-day moving average.

- If 1-3 are true, then buy at the close.

- Sell at the close tomorrow.

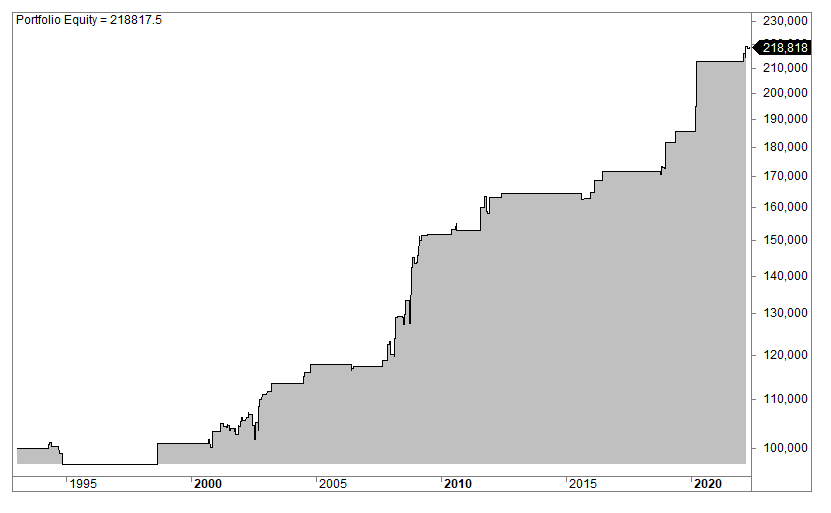

The equity curve looks like this:

The average gain is a solid 0.84%.

What happens if we flip it and take trades only when the close is above the 200-day moving average?

[/am4show]

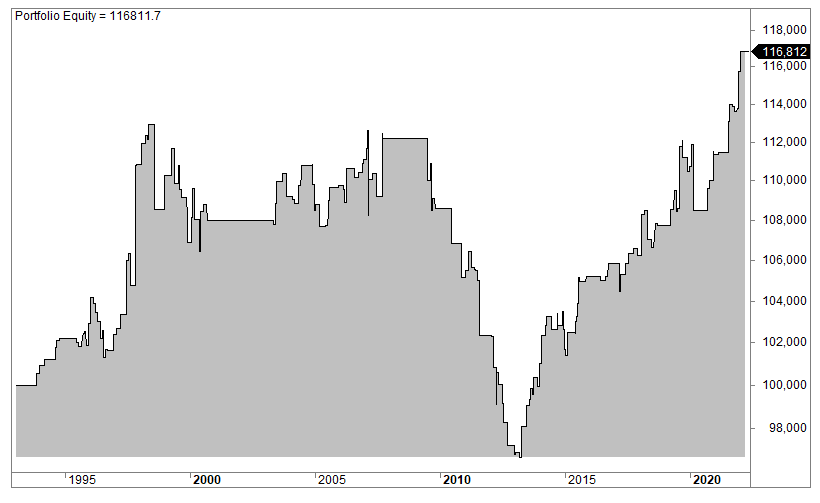

Here it is:

The average gain drops to a tiny 0.09%.

As you can see, it performs much better in a bear market.

FAQ:

How does the Turnaround Tuesday strategy perform in bear markets?

The article tests the Turnaround Tuesday strategy specifically in a bear market context. It explores the hypothesis of buying when certain conditions align during down days and selling the next day. The strategy is analyzed using the S&P 500 (SPY) as an example.

What are the conditions for implementing the Turnaround Tuesday strategy in a bear market?

In a bear market, the conditions for implementing the strategy include: Today is Monday, both today and yesterday (Friday) were down days, and today’s close is below the 200-day moving average. If these conditions are met, the strategy suggests buying at the close and selling the next day.

Why does the Turnaround Tuesday strategy perform better in a bear market?

The Turnaround Tuesday strategy performs better in a bear market based on the specific conditions chosen for implementation. The article analyzes and explains the performance differences, providing insights into the strategy’s effectiveness during market downturns.