Weekly Mean Reversion System for S&P 500 Stocks: Rules and Backtest Analysis

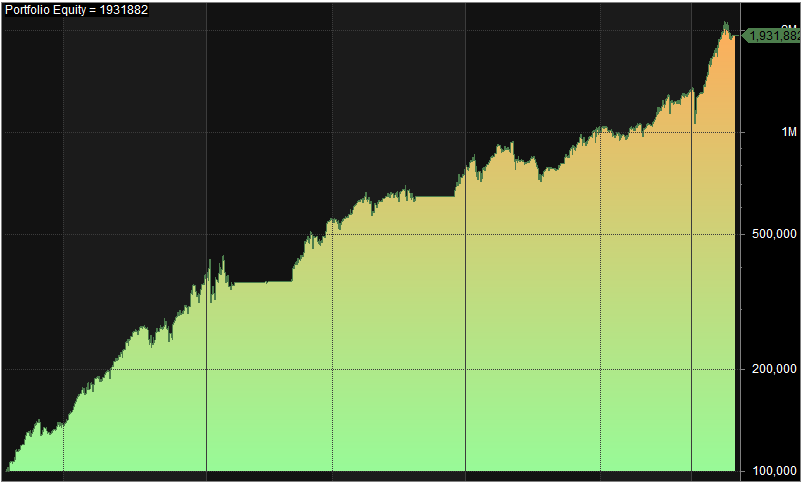

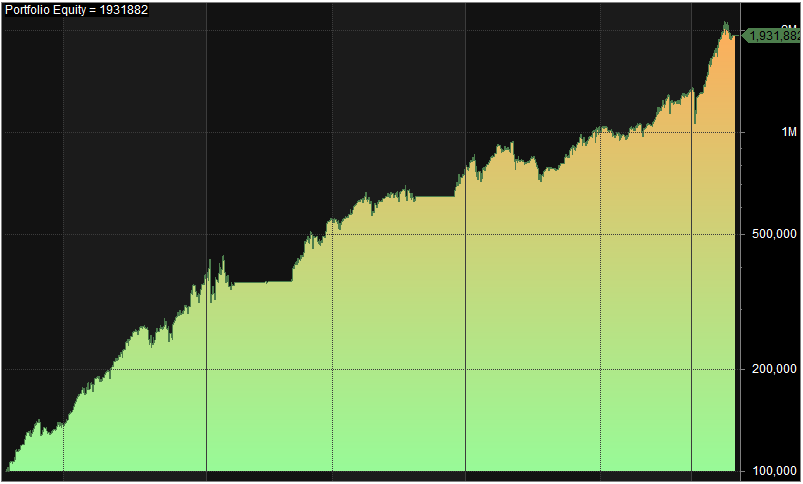

This article presents a stock trading system that only trades stocks. It has beaten buy&hold and (10.4% vs 7.5%) with a much lower drawdown. This is the equity curve and the complete trading rules are presented further down in the article:

What is a mean reversion system?

Mean reversion is a trading strategy based on the principle that over time, the price of an asset tends to revert to its historical average. In other words, if an asset’s price moves too far away from its average, it’s expected to return to that average eventually.

A mean reversion system is a type of trading system that uses this principle to make trading decisions. It typically involves identifying an asset that has deviated significantly from its historical mean, then buying or selling it in the hope that it will eventually revert to its mean. This strategy assumes that the asset’s price will eventually revert to its mean and generate a profit for the trader.

To implement a mean reversion system, traders typically use technical indicators such as moving averages, Bollinger Bands, or RSI (Relative Strength Index) to identify when an asset’s price is overbought or oversold. They then use this information to make buy or sell decisions.

Timeframe considerations: weekly vs. daily

The decision to use weekly bars instead of daily bars in trading depends on your trading style and the time horizon of your trades.

Here are some reasons why you might consider using weekly bars:

- Smoothing out market noise: Weekly bars can help smooth out the day-to-day fluctuations in the market, providing a clearer picture of the longer-term trends. This can help reduce the impact of short-term market noise and allow you to focus on the bigger picture.

- Better trade timing: Because weekly bars capture a longer period, they can help you identify key support and resistance levels, trend lines, and other important technical indicators more accurately.

- Reduce time commitment: If you are a part-time trader or have a busy schedule, using weekly bars can reduce the time commitment required to monitor the markets. You can check your charts once a week instead of every day, freeing up more time for family, friends, or other activities.

- Reducing transaction costs: By reducing the number of trades you make, you can also reduce your transaction costs. This is especially important for traders who trade frequently or have smaller accounts.

The strategy’s trading rules

With this strategy, we’re trying to benefit from weekly drawdowns/pullbacks in S&P 500 stocks – not the index.

[am4show have=’p2;p3;p58;p59;p130;p138;’ user_error=’Premium Post Access’ guest_error=’Premium Posts’]

Each weekend the 2-week RSI is evaluated for all stocks within the index. If the RSI value crosses below 25, a limit buy order is placed 5% below the last weekly close, valid for next week.

The position size for each position is 10% of the equity (make sure that the maximum number of positions is not exceeded). The position is sold at the next day open (Monday) as soon as the 2-weekly RSI exceeds 75.

Using weekly bars instead of daily bars makes it relatively easy to trade this system. There’s plenty of time on the weekend to check for new buy and sell orders and to put orders in the market.

No stop loss is used.

As we’re trading the stocks of the S&P500 index, meaning the 500 largest U.S. companies listed on the New York Stock Exchange and Nasdaq, we can limit the chances that one company goes belly up or have a major crash. If that were the case, one would “only” lose 10% equity since we’re trading a portfolio of maximum of 10 stocks at the same time.

For the full trading rules see the following lists:

Buy rules:

- Weekly bars

- The index price (S&P 500) needs to be above the 52-week moving average

- The stock needs to be part of S&P 500 index

- The stock price needs to be above the 52-week moving average

- If RSI(2) < 25, then place a limit order 5% below the closing price, the order is valid for one week

- Position size: 10%

- If there are more signals than open slots, the rate of change ranking of the last 52 weeks is used.

Sell rules:

- If RSI(2) > 75, sell on the next day’s open.

Backtest settings:

- Time range: 1993 till the end of 2022

- Data provider: Norgate Premium, survivorship-bias free

- Commissions per trade: $2

[/am4show]

Strategy backtest and performance

For the backtest, we used Norgate data with no survivorship bias.

Within the backtested time range, the strategy performs with a CAGR of 10.4% while being invested 48% of the time (dividends not taken into account and thus underestimating the performance).

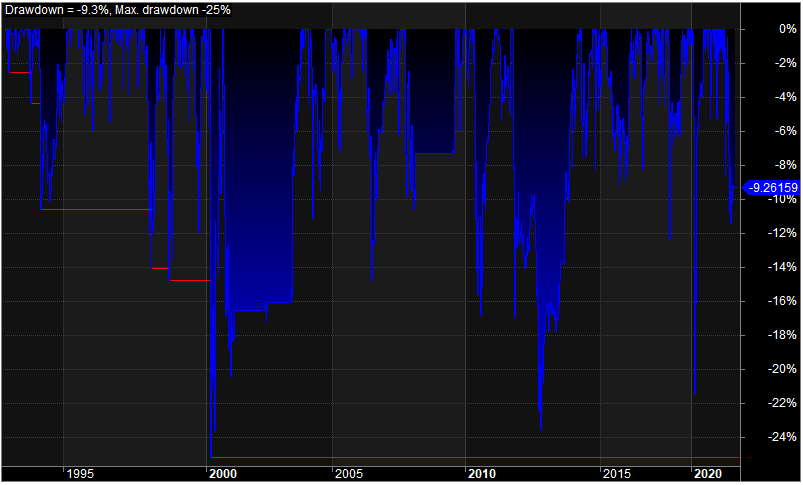

In almost 30 years, roughly 1000 trades were executed. The maximum drawdown is -25%, and the win rate is 71%, with an average Profit/Loss of 3.2%. These are solid metrics for such a “low effort” strategy.

In the same time range, the buy&hold strategy has a CAGR of 7.5%, but with a more severe maximum drawdown of -56%.

Starting with an initial equity of 100 000 USD, buy&hold ends with an equity of 870000 USD, while the strategy finishes 2022 with 1.93 Million USD.

Things to consider

Although we are backtesting very liquid stocks and quality data from Norgate, the backtest might overestimate the results based on two things:

- Our limit level might be part of “bad quote”, even though we have used Norgate

- Our limit level might have just a few shares traded and we get a partial fill or nothing at all, even though this is very liquid S&P 500 stocks

Conclusion

The weekly mean reversion system based on S&P 500 stocks outperforms buy&hold significantly. Although the interested trader/investor only needs to spend a few minutes every weekend, a clear edge is visible.

With some more parameter studies, the strategy can be further tweaked for your needs, e.g., adjusting the RSI values for the buy and sell trigger to lower or increase the exposure to the market, for example.

Disclaimer

Quantified Strategies (SIA Lofjord) is not an investment advisor. The content and information provided are educational and should not be treated as financial advisory services or investment advice. Trading and investment in securities involve substantial risk of loss and is not recommended for anyone that is not a trained trader or investor – it shall be conducted at your own risk. It is recommended that you never risk more than you are willing to lose. Leverage can lead to substantial losses. Any use of leverage, margin, or shorting is at your discretion. Quantified Strategies (SIA Lofjord) is not responsible for any losses that occur as a result of its content and information.

Hypothetical or simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, Since the trades have not been executed, the results may have under or overcompensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs, in general, are also subject to the fact that they are designed with the benefit of hindsight. No representations are made that any account will or is likely to achieve profit or losses similar to those shown.

FAQ:

What is a mean reversion system in stock trading?

A mean reversion system is a trading strategy that relies on the principle that over time, the price of an asset tends to revert to its historical average. In simple terms, if an asset’s price deviates significantly from its average, the strategy expects it to return to that average, providing opportunities for profitable trades.

How does the mean reversion system outperform buy&hold?

The mean reversion system showcased in the article uses weekly bars to identify S&P 500 stocks with significant drawdowns. By strategically entering and exiting positions based on the 2-week RSI, the system achieves a Compound Annual Growth Rate (CAGR) of 10.4%, outperforming buy&hold with a lower drawdown.

Why choose weekly bars over daily bars in trading?

Weekly bars offer advantages such as smoothing out market noise, better trade timing, reduced time commitment for part-time traders, and lower transaction costs. They provide a clearer picture of longer-term trends and allow traders to focus on key technical indicators.