The Best Trading Hour For: Gold, Oil, Silver, SP500, and Swiss Franc

What trading hour is the best? Does the time of day make a difference when trading? When should you buy and sell during the trading day? We test: Gold, Oil, Silver, SP500, and Swiss Franc

Seasonal trading strategies can take many forms in any time frame. This article looks at intraday data for some of the most traded futures contracts.

There is no best trading hour. Backtests of five different futures contracts reveals that most of the price action is random throughout the trading day. However, by implementing one or two extra variables we find some potential trading edges or strategies.

Let’s go straight to our backtesting:

What trading hour is the best?

In order to find the best trading hour, we look at five different futures contracts: S&P 500 (ES), USD/CHF, the oil price (CL), gold (GC), and silver (SI). Our futures data start in July 2010 or July 2011.

What trading hour is the best? Backtest no. 1:

[am4show have=’p2;p3;p58;p59;p130;p138;’ user_error=’Premium Post Access’ guest_error=’Premium Posts’]

In test no. 1 we buy at the open every hour and sell at the close of the trading day. The close is defined as the close of the “regular” trading hours local time.

For example, the S&P 500 futures contract is traded in Chicago and we defined the open at 0830 local time and the close at 1500.

For gold, oil, and silver the open is 0930 and the close is 1600 because it trades in New York.

All of the contracts trade much longer (and earlier), but for convenience, we defined the open and close like above.

We test one-hour intervals: 0830, 0930…..1530. Thus, the last time interval is only 30 minutes.

[/am4show]

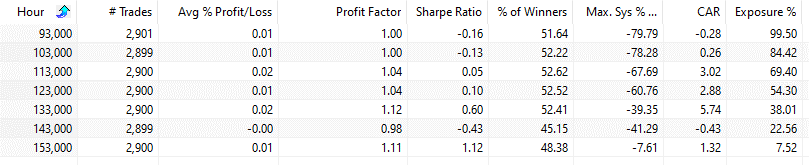

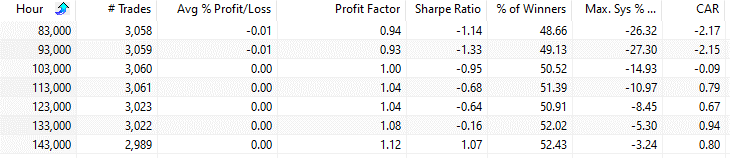

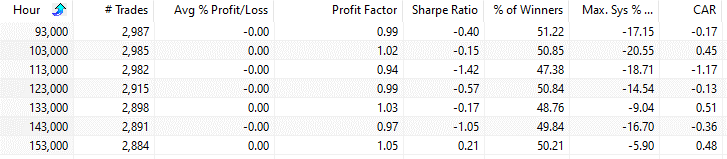

Oil:

We start by testing the oil WTI contract:

The first column shows the time when we enter the trade: 93 000 is 0930 and 123 000 is 1230 etc.

As you can see from the table, the average percentage gains are small.

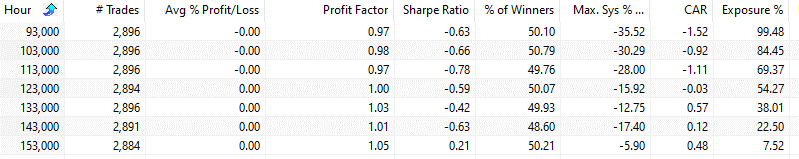

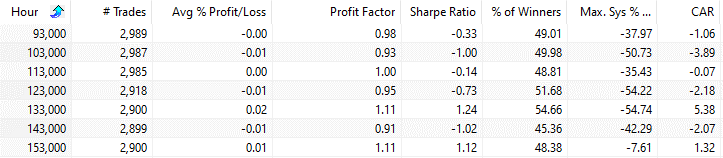

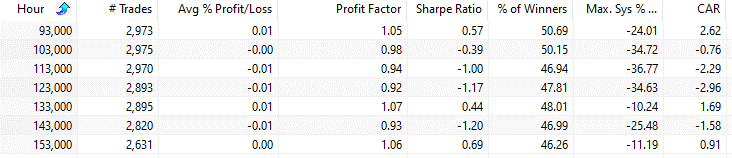

Gold:

In the gold price the average gains are practically zero:

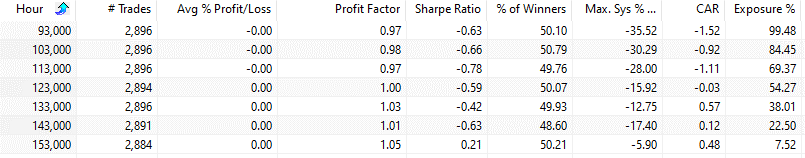

Silver:

Just as in gold it seems to be complete randomness in the silver contract throughout the trading day:

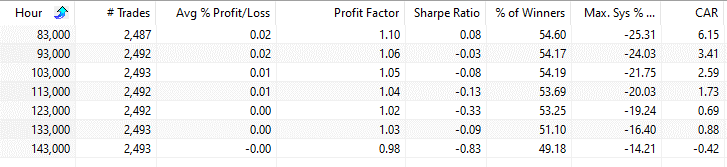

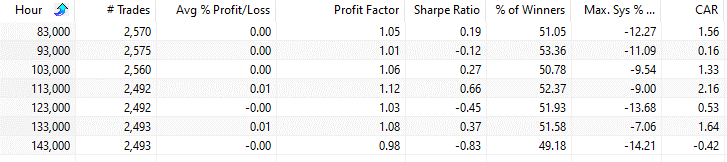

S&P 500:

The bullish market since the financial crisis in 2008/09 has created a positive drift from the morning until the close (in addition to the overnight edge):

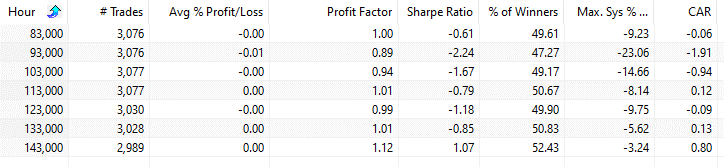

USD/CHF:

Perhaps as expected, the USD/CHF rate seems pretty random:

What trading hour is the best? Backtest no. 2:

[am4show have=’p2;p3;p58;p59;p130;p138;’ user_error=’Premium Post Access’ guest_error=’Premium Posts’]

We make a second backtest, but this time we only look at the returns per hour during the trading day.

If you buy the S&P 500 at the open (0830) you sell one hour later (0930) and so on:

[/am4show]

S&P 500:

A pretty non-existent pattern in the S&P 500. However, you might want to check out our older article about the return during the last hour of trading.

USD/CHF:

Forex is mainly a relative game between two assets and seems to be pretty random:

Oil:

The same goes for oil:

Gold:

Not much to cheer about in gold:

Silver:

And silver performs very much like gold (much of the time):

Both of the backtests reveal that there are no tradeable patterns. That is, of course, expected. If it was any, it would be “arbed” away a long time ago.

Amibroker code:

This backtest and optimization was done in Amibroker. If you like to have the code for the test plus all the other code for the free trading strategies we have made over the last 10 years, you can order the code here:

Additionally, you get a lot of Tradestation code included.

What Trading Hour Is The Best?

The tests done in this article might point to randomness, but there are many alternatives to find profitable trading edges in the same data.

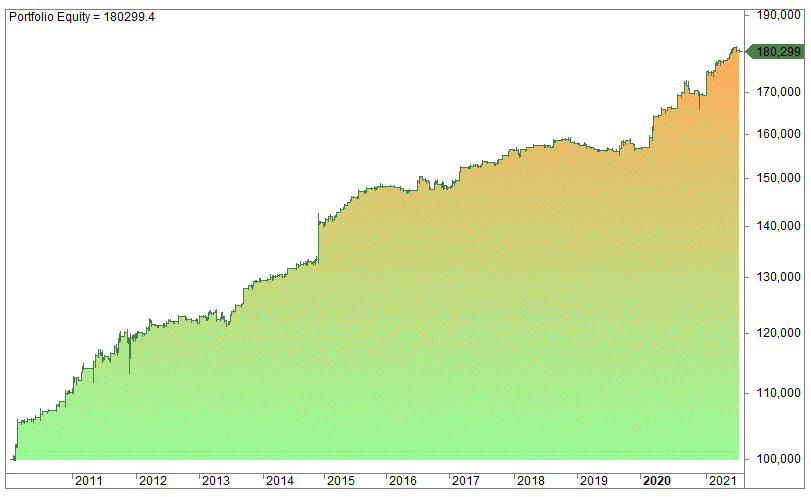

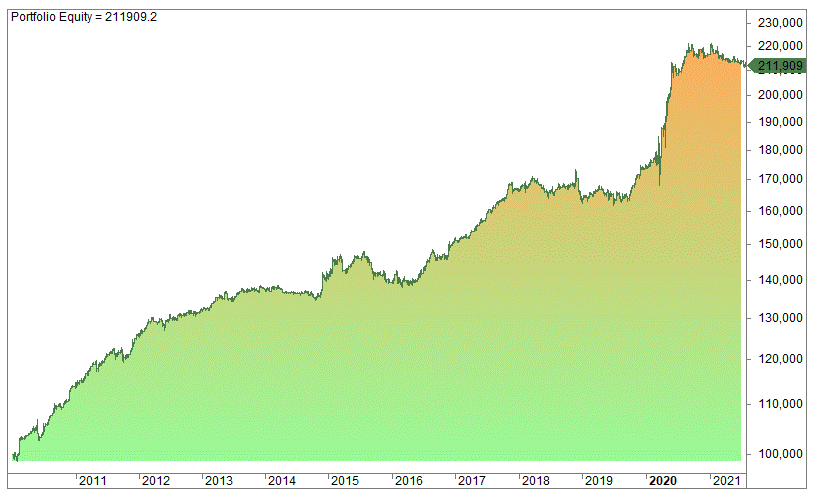

For example, we have this equity curve in the silver contract that enters at a certain time and exits a few hours later during the same trading day:

In addition to the time, we added one variable. The average is 0.21% assuming a 100% margin. There are almost 300 trades, the win ratio is 60% and the average winner is twice as big as the average loser. The profit factor is 3.

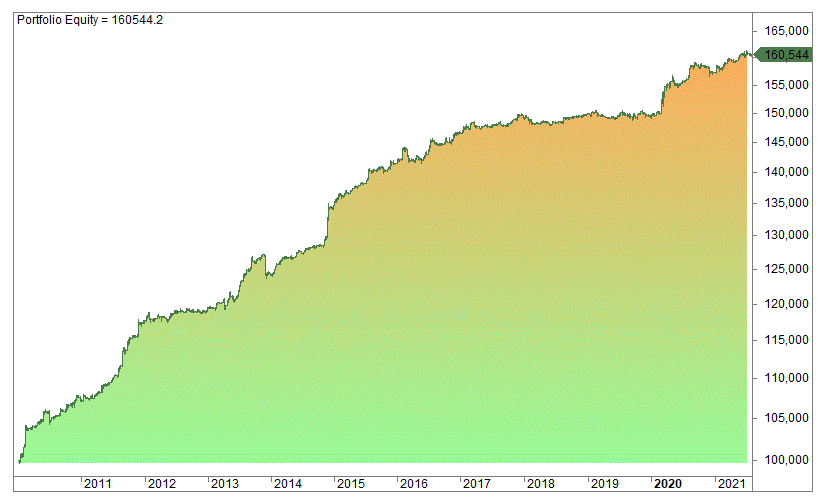

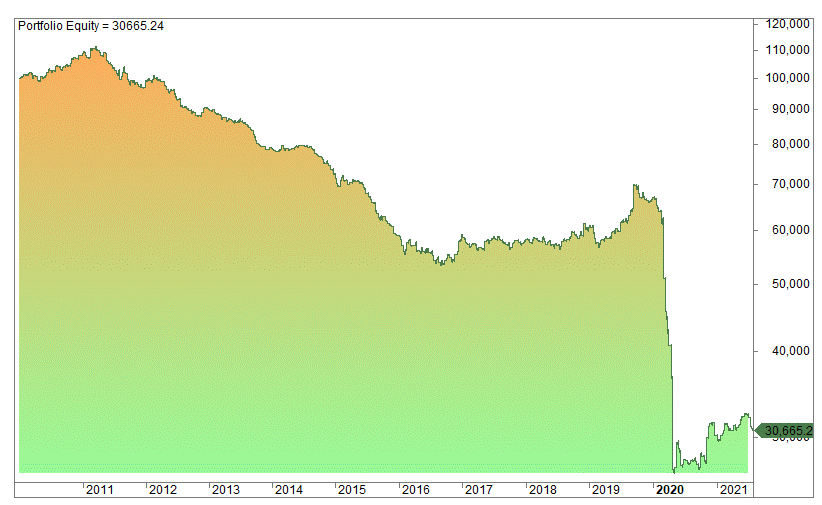

Or what about this one in gold, also by adding just one variable in addition to the time criteria:

The average gain per trade is 0.1% unleveraged over 600 trades.

And we have one in oil as well, also by adding one variable:

And we bring you the last chart of the day, in oil, that holds overnight (obviously a potential short strategy):

What trading hour is the best? Conclusion

Almost all price action intraday is randomness and noise and it’s impossible to determine what trading hour is the best.

That said, we believe you can take advantage of some structural inefficiencies based on time and seasonality as the last four charts indicate.

There is a lot of work involved in writing these articles. Most of my work is free but if you like what I do please consider supporting me.

FAQ:

How were the backtests performed to identify potential trading edges or strategies?

Two backtests were conducted. In the first test, trades were initiated at the open every hour, and positions were closed at the close of the regular trading hours. In the second test, returns per hour during the trading day were analyzed. Both tests aimed to explore if specific trading hours showed consistent patterns.

How does seasonality play a role in determining profitable trading edges based on time?

While the tests in this article lean towards randomness in intraday price action, there are alternative approaches to finding profitable trading edges. By incorporating additional variables, such as time and seasonality, traders may identify structural inefficiencies. Examples include strategies in silver, gold, and oil that showed potential profitability with added variables.

What are the key takeaways from the article regarding determining the best trading hour?

The key takeaway is that intraday price action is predominantly random, making it difficult to pinpoint a single best trading hour. However, the article suggests that traders can explore potential opportunities by incorporating additional variables and considering structural inefficiencies.