Nasdaq 100 & Treasury Bond Relationship/Rotation Trading Strategy Explained

For those who follow social media, you might be aware of the following ratio that is frequently discussed:

Nasdaq100 & Treasury Bond Bond relationship.

What is it, and is it profitable?

In this article, we explain the ratio and we backtest it.

The backtested result looks like this:

QQQ/TLT

This is the ticker code of the ETFs of Nasdaq 100 (QQQ) and 20(+) – year Treasury Bonds (TLT).

We are trying to trade divergences between the two ETFs.

Normally, interest rates have a huge impact on stocks: rising rates are bad. We previously wrote about this in our article called what happens to stocks when bonds go down.

What happens when there is a divergence?

A divergence happens when stocks go up while interest rates go sideways or up (remember, if a bond falls in value, the interest rates are going up while rising bond prices mean lower rates).

Let’s go to backtest the following strategy to see if there is any value in the QQQ/TLT ratio:

Trading Rules

[am4show have=’p2;p3;p58;p59;p130;p138;’ user_error=’Premium Post Access’ guest_error=’Premium Posts’]

- We make a “spread” of QQQ and TLT. This is simply the price of QQQ divided by TLT.

- We make a 4-day RSI of the spread in number 1.

- When the value in number 2 is below 20, we go long QQQ and short TLT. We cover when the RSI rises above 50.

- When the value in number 2 is over 80, we go short QQQ and long TLT. We cover when the RSI drops under 50.

- All buying and selling are done at the close.

- We allocate 60% of the capital to QQQ and 40% to TLT (QQQ is more volatile).

[/am4show]

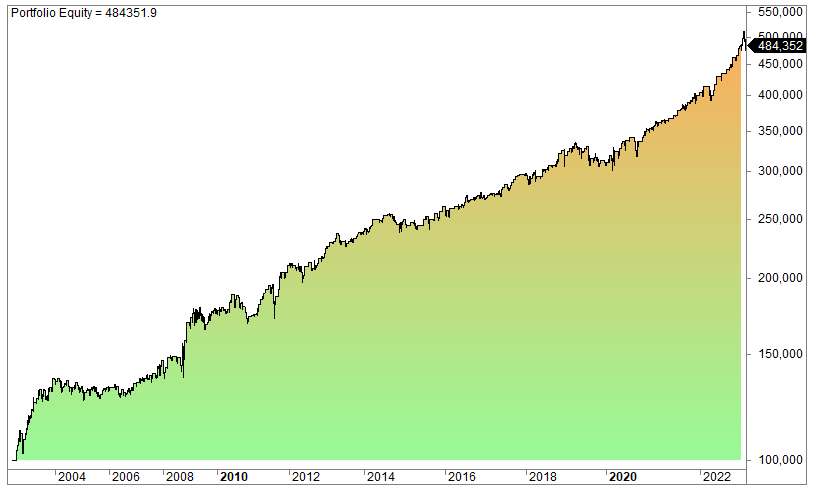

Let’s look at how our strategy has performed since the summer of 2002:

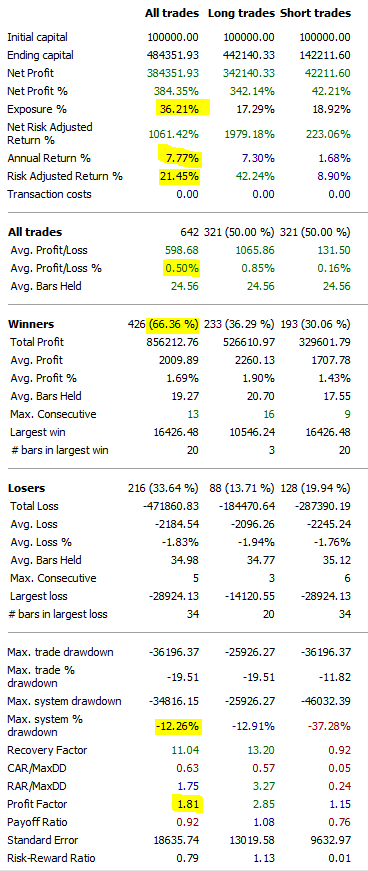

There are 642 trades and the average gain per trade is 0.5% (before commission and slippage). Interestingly, almost all the gains comes from the long side – short trades are not contributing much. CAGR is 7.77%, and risk-adjusted return is 21%.

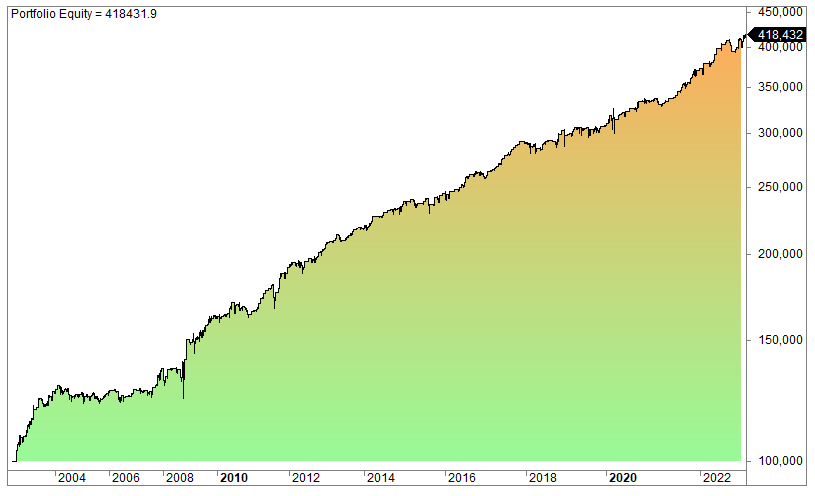

What happens if we only take long trades?

You get 7% annually despite being invested only 17% of the time. Thus, the indicator is a pretty good indicator for long trades (both QQQ and TLT).

(If you want to read more about risk-adjusted returns, please read our article about trading performance metrics.)

Disclaimer

Quantified Strategies (SIA Lofjord) is not an investment advisor. The content and information provided are educational and should not be treated as financial advisory services or investment advice. Trading and investment in securities involve substantial risk of loss and is not recommended for anyone that is not a trained trader or investor – it shall be conducted at your own risk. It is recommended that you never risk more than you are willing to lose. Leverage can lead to substantial losses. Any use of leverage, margin, or shorting is at your discretion. Quantified Strategies (SIA Lofjord) is not responsible for any losses that occur as a result of its content and information.

Hypothetical or simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, Since the trades have not been executed, the results may have under or overcompensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs, in general, are also subject to the fact that they are designed with the benefit of hindsight. No representations are made that any account will or is likely to achieve profit or losses similar to those shown.

FAQ:

Why is the Nasdaq 100 & Treasury Bond ratio important for investors?

The Nasdaq 100 & Treasury Bond ratio refers to the relationship between the Nasdaq 100 ETF (QQQ) and the 20(+) – year Treasury Bond ETF (TLT). The ratio is significant because it involves trading divergences between QQQ and TLT, attempting to capitalize on market movements influenced by interest rates and stock prices.

What does a divergence in the QQQ/TLT ratio indicate?

A divergence occurs when stocks (QQQ) go up while interest rates represented by TLT go sideways or up. It’s a situation where stock prices move independently of changes in interest rates. The spread is simply the price of QQQ divided by TLT. This spread forms the basis for the backtesting strategy.

What are the key trading rules in the backtesting strategy for QQQ/TLT?

The strategy involves creating a spread of QQQ and TLT, calculating a 4-day RSI of the spread, and making trades based on RSI levels. Long positions are initiated when RSI is below 20, and short positions when RSI is above 80. 60% of the capital is allocated to QQQ, and 40% to TLT, reflecting the higher volatility of QQQ.