Returns After a Very Bad Friday in the Stock Market: What Can We Expect?

What happens in the coming days after a very bad Friday when the stock market goes down? Let’s backtest and find out if we can make any money from it.

Friday 22nd of April was a very bad day in the stock market. The S&P 500 dropped 2.75%, something that doesn’t happen so frequently: the S&p 500 has dropped more than 2.5% 145 times since 1993, but only 31 times on a Friday.

What returns can we expect in the coming days after such a bad Friday? Let’s backtest the following:

[am4show have=’p2;p3;p58;p59;p130;p138;’ user_error=’Premium Post Access’ guest_error=’Premium Posts’]

- Today is Friday and the market is 2.5% lower than yesterday’s close. We buy at the close

[/am4show]

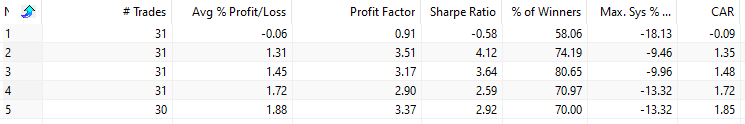

This is the result if we sell at the close N days later:

The first column shows the day of the week when we exit. As you can see, there is a “spillover” into Monday as on average S&P 500 shows a lower close.

However, on Tuesday and the rest of the week, the returns are very good.

FAQ:

How often does the stock market experience a drop of more than 2.5%, especially on a Friday?

Since 1993, the S&P 500 has experienced a drop of more than 2.5% on 145 occasions, but interestingly, it occurred only 31 times specifically on a Friday. This rarity in Friday occurrences adds an intriguing aspect to the analysis. The analysis was prompted by a specific event, a notably bad Friday in the stock market where the S&P 500 dropped by 2.75%.

Why choose to explore the market behavior after a bad Friday specifically?

Exploring the market behavior after a bad Friday provides insights into potential patterns and trends that may emerge in the days following a significant drop. This analysis can be valuable for traders and investors looking to make informed decisions based on historical market reactions.

What is the significance of the “spillover” effect observed into Monday in the analysis?

The “spillover” effect into Monday suggests that the impact of a bad Friday extends into the following trading day. This observation underscores the interconnectedness of consecutive market days and the need to consider potential trends over the weekend.