FAANG Trading Strategies (Backtest And Performance)

What Is FAANG and What Does It Stand For?

FAANG is an acronym that represents five of the most prominent and influential technology companies in the world.

Each letter in FAANG stands for one of these companies:

- Facebook (now Meta Platforms, Inc.): A social media giant known for its flagship platform, Facebook, as well as other platforms like Instagram and WhatsApp.

- Apple Inc.: A multinational technology company famous for its iPhones, iPads, Mac computers, and other consumer electronics.

- Amazon.com Inc.: The world’s largest online retailer, offering a wide range of products and services, including e-commerce, cloud computing, and digital streaming.

- Netflix Inc.: A leading subscription-based streaming service known for its extensive library of movies and TV shows.

- Google (now Alphabet Inc.): A multinational conglomerate that owns Google, the world’s most popular search engine, as well as other ventures like YouTube and Waymo (self-driving cars).

The FAANG companies are significant in the world of finance and technology for several reasons:

- Market Capitalization: These companies have some of the largest market capitalizations in the world, collectively accounting for a substantial portion of the stock market’s total value. As of writing, they account for about 25% of the market cap in S&P 500!

- Innovation: They are at the forefront of technological innovation, continuously introducing new products, services, and technologies that shape industries and consumer behavior. They have what Warren Buffett would call an enormous “moat”.

- Disruption: FAANG companies have disrupted traditional industries, such as retail (Amazon), media and entertainment (Netflix), and advertising (Google), leading to significant changes in these sectors. However, we know that technology changes, so we might expect these companies to be disrupted themselves sometime in the future.

- Investment Appeal: Investors often view FAANG stocks as attractive investment options due to their history of strong growth and profitability.

- Global Reach: These companies have a global presence, serving billions of users and customers worldwide, making them influential players in the global economy.

Before you continue reading, we remind you that we have 100s of profitable and backtested trading strategies. Some are behind a paywall, but if you become a member you get access for as low as 1 USD.

This article is partially written with AI, and partially by us.

FAANG Trading Strategies (Backtest)

FAANG stocks have outperformed the rest of the market over the last decade – since the end of the financial crisis in 2008/09.

Let’s look at an equal weight vs market weight trading strategy.

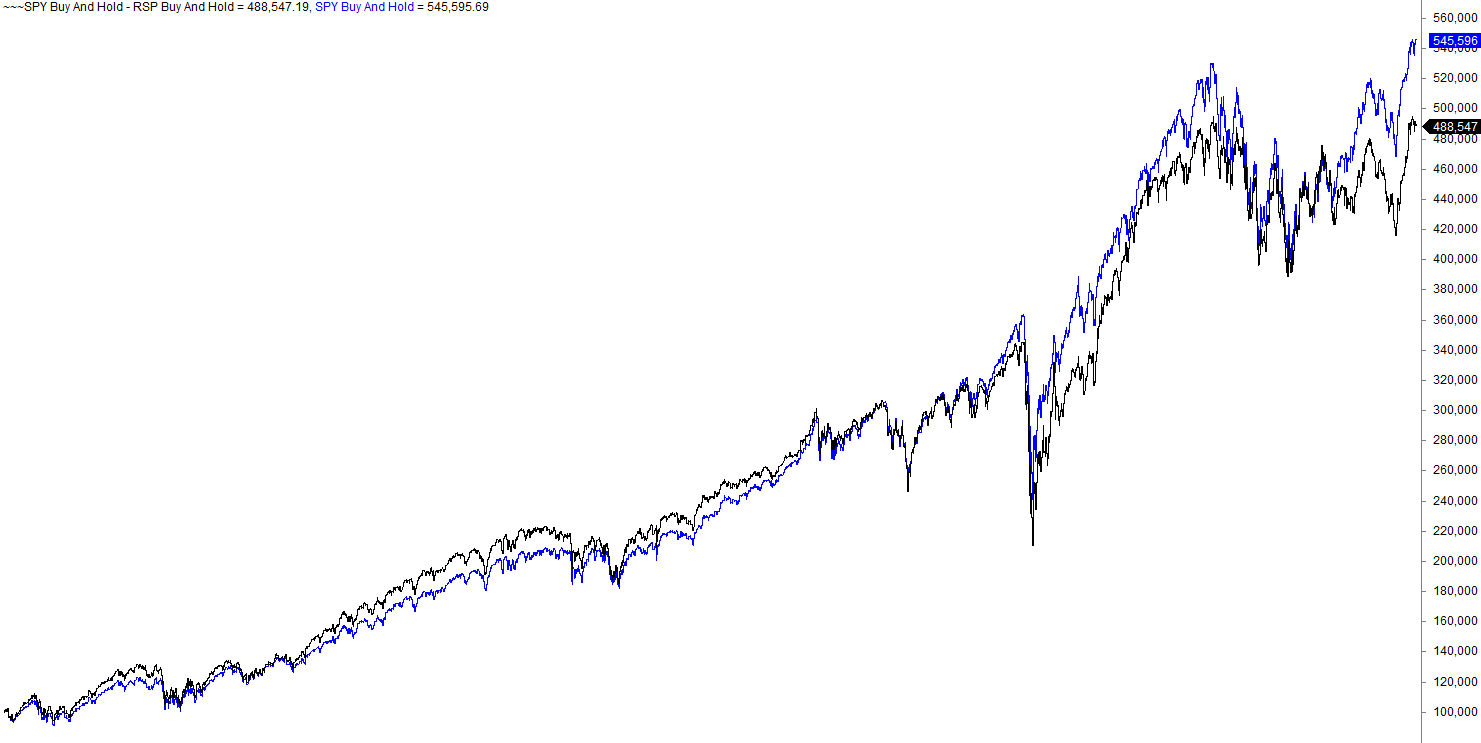

We buy SPY and RSP in January 2010. SPY is the ticker code for the oldest ETF still trading, and tracks S&P 500. S&P 500 is a market-weighted index.

RSP is the ticker code for Invesco’s ETF that tracks the equal-weighted version of S&P 500. This means that the holdings are the same, but their weightings are very different.

Let’s look at the performance from 2010 until today:

The black line is RSP and the blue line is SPY. Clearly, SPY has outperformed RSP substantially.

The reason for the outperformance is the FAANG stocks. That said, this FAANG trading strategy is partially based on survivorship bias. We know they have outperformed. If they continue to do so so remains to be seen.

However, if you look at the long-term history, you’ll see that the equal-weighted version has outperformed market-weighted.

Who Are The FAANG Companies? Core Business Activities

The FAANG companies are a group of five prominent technology giants in the United States.

Here’s a brief description of each company and their core business activities:

- Facebook (now Meta Platforms, Inc.):

- Core Business: Meta Platforms, Inc., formerly known as Facebook, is primarily focused on social media and online social networking. They operate the world’s largest social networking platform, connecting billions of people globally.

- Apple Inc.:

- Core Business: Apple is known for its hardware and software products, including the iPhone, iPad, Mac computers, and iOS operating systems. They also offer digital services like the App Store, iCloud, and Apple Music.

- Amazon.com, Inc.:

- Core Business: Amazon is the world’s largest online retailer, offering a vast range of products and services, including e-commerce, cloud computing (Amazon Web Services or AWS), streaming (Amazon Prime Video), and digital assistants (Alexa).

- Netflix, Inc.:

- Core Business: Netflix is a subscription-based streaming service that provides a vast library of movies, TV shows, and original content. They are a leader in the entertainment industry’s transition to digital streaming.

- Google (Alphabet Inc.):

- Core Business: Google, under its parent company Alphabet Inc., is a technology conglomerate with a diverse portfolio. Google’s core activities include internet search, online advertising (AdWords), and services such as YouTube, Android, and Google Cloud. Alphabet also invests in other technology ventures and research through its various subsidiaries.

Why Are FAANG Companies Important?

FAANG companies, which include Facebook (now Meta), Apple, Amazon, Netflix, and Google (now Alphabet), hold significant importance in today’s world. Their collective impact spans across various dimensions:

These companies wield immense economic power, influencing markets and the global economy. Their market capitalization and financial strength are unmatched.

FAANG firms are at the forefront of technological innovation, consistently pushing the boundaries of what is possible in areas like software, hardware, and artificial intelligence.

They play a crucial role in job creation, directly employing millions of people while also contributing to employment indirectly through their ecosystem.

Their products and services have become deeply ingrained in our daily lives, shaping how we communicate, shop, consume content, and access information.

The vast amount of user data they collect has implications for privacy and the digital economy, prompting discussions around regulation and policy.

Market dominance in their respective sectors raises questions about competition, antitrust regulations, and the concentration of power.

Their stock performance and market influence make them attractive to investors, impacting overall market sentiment.

FAANG companies have a global reach, affecting not just the United States but also markets and societies worldwide.

They exert cultural influence, shaping popular culture and trends, both through their products and their influence on the tech and entertainment industries.

Their strategies and decisions set trends for the tech industry, shaping the trajectory of technology and business in the years to come.

They have tremendous market power, and have partial “monopoly” in certain business areas.

FAANG Stock Performance and Investment Potential

Here’s an analysis based on the data available:

1. Historical Stock Performance:

- Facebook (Meta Platforms, Inc.): Facebook’s stock had experienced significant growth since its IPO in 2012. The company’s advertising-driven revenue model and the acquisition of Instagram and WhatsApp contributed to its strong performance. However, it faced challenges related to privacy concerns and regulatory scrutiny.

- Apple Inc.: Apple’s stock had shown remarkable growth over the years, thanks to its diverse product portfolio, strong brand loyalty, and robust ecosystem. The company consistently delivered strong sales of iPhones, Macs, iPads, and services like the App Store and Apple Music.

- Amazon.com, Inc.: Amazon’s stock had also seen impressive growth, driven by its dominant position in e-commerce, cloud computing (Amazon Web Services), and expansion into various industries like groceries and streaming services.

- Netflix, Inc.: Netflix’s stock had been on a growth trajectory, primarily due to its dominance in the streaming industry and global subscriber growth. However, competition was increasing in the streaming space, which posed a challenge.

- Alphabet Inc. (Google): Google’s stock had performed well, driven by its advertising business, YouTube, and cloud computing services. The company had faced regulatory scrutiny and antitrust concerns but maintained a dominant position in online search and digital advertising.

2. Key Financial Metrics:

- Revenue Growth: These companies had shown consistent revenue growth over the years, with some experiencing more significant fluctuations due to their business models and market dynamics.

- Profit Margins: Profit margins varied among these companies, with some, like Amazon, often prioritizing reinvestment over high margins. But in general, profit margins are very high and a few of them “print money”.

- Cash Reserves: Many FAANG companies had substantial cash reserves, which allowed them to invest in research and development, acquisitions, and other growth initiatives.

3. Growth Trends:

- E-commerce and Cloud Computing: Amazon was a leader in e-commerce, while Amazon Web Services (AWS) dominated the cloud computing market.

- Streaming Services: Netflix had a strong presence in the streaming industry, but it faced competition from new entrants like Disney+ and HBO Max.

- Digital Advertising: Google and Facebook were the dominant players in the digital advertising space.

- Hardware and Services: Apple’s hardware and services divisions continued to grow, with products like the iPhone, Mac, and services like Apple Music and the App Store.

4. Factors Affecting Investment Potential:

- Regulatory Risks: These companies faced regulatory challenges related to antitrust concerns, data privacy, and content moderation. Regulatory changes could impact their business models.

- Competition: Competition in their respective markets was intense, and the ability to innovate and stay ahead was crucial for sustained growth.

- Global Economic Factors: Economic downturns or global events like the COVID-19 pandemic could impact consumer spending and business operations.

- Technological Advances: Rapid technological changes could present opportunities and threats to these companies. Staying at the forefront of innovation was crucial.

Regulatory Challenges and Controversies

In recent years, FAANG companies (Facebook/Meta, Apple, Amazon, Netflix, and Google/Alphabet) have encountered various regulatory and legal challenges, along with controversies and ethical concerns surrounding their operations.

- Antitrust Issues: Google, Amazon, and Apple have faced antitrust investigations and lawsuits for alleged anti-competitive practices and abuse of market power.

- Data Privacy and Security: Facebook/Meta and Google have been embroiled in data privacy controversies, including the Cambridge Analytica scandal and GDPR violations.

- Content Moderation: Facebook/Meta and Twitter have grappled with criticism over content moderation policies, censorship, and allegations of bias.

- Labor and Employment: Amazon has faced scrutiny for labor conditions in its warehouses, while gender and racial disparities in tech company workforces have sparked concerns.

- Taxation: FAANG companies have been criticized for minimizing tax payments through offshore structures.

- Ethical Dilemmas: AI ethics, environmental impact, and ethical considerations in surveillance technologies have emerged as concerns.

- Government Surveillance: These firms have faced pressure to cooperate in government surveillance efforts, raising privacy and national security questions.

- Misinformation: Facebook/Meta and Twitter have been implicated in the spread of fake news and misinformation, particularly in the context of elections.

FAANG’s Impact on Technology and Society

The FAANG companies – Facebook, Amazon, Apple, Netflix, and Google – have had a profound and transformative impact on the technology landscape and societal behaviors. These tech giants have revolutionized communication, commerce, entertainment, and information access, fundamentally altering how we interact with the world around us.

Data Privacy

FAANG companies have been at the forefront of the data privacy debate, collecting and analyzing vast amounts of user data to personalize experiences, target advertising, and improve their services. While this data collection has fueled innovation, it has also raised concerns about privacy, security, and potential misuse.

The Cambridge Analytica scandal, in which Facebook’s data was used for political manipulation, highlighted the vulnerabilities of data-driven businesses and the need for stronger data protection regulations.

Online Content

FAANG companies have played a central role in shaping the online content we consume, determining what we see, share, and engage with. Their algorithms curate our news feeds, recommend products, and influence our entertainment choices.

This algorithmic power has been criticized for its potential biases, echo chambers, and spread of misinformation, raising questions about the role of technology in shaping public discourse and influencing societal norms.

Digital Transformation

FAANG companies have been instrumental in driving digital transformation across industries, from retail and finance to healthcare and education. Their innovative technologies have streamlined processes, enhanced customer service, and empowered individuals to work, learn, and connect in new ways.

However, this digital shift has also raised concerns about job displacement, the widening digital divide, and the potential for surveillance and control.

Social Impact

FAANG companies have had a significant impact on societal behaviors, shaping our communication patterns, consumption habits, and political engagement. Their platforms have become primary channels for social interaction, information sharing, and political discourse. While this has fostered connection and collaboration, it has also amplified echo chambers, facilitated the spread of misinformation, and influenced political polarization.

The FAANG companies’ impact on technology and society is multifaceted and complex, bringing both benefits and challenges. Their innovations have revolutionized communication, commerce, and entertainment, but their data collection practices, algorithmic decisions, and influence over online content have raised concerns about privacy, misinformation, and bias.

As we navigate the digital age, it is crucial to critically examine the impact of FAANG companies on our lives and work towards responsible technological development that promotes individual rights, societal well-being, and democratic values.

Future Outlook and Challenges for FAANG

While the FAANG companies (Facebook, Amazon, Apple, Netflix, and Google) have dominated the technology landscape for the past decade, their future prospects are not without challenges. As technology evolves and consumer preferences shift, these companies will need to adapt and innovate to maintain their market dominance.

Competition

The FAANG companies face increasing competition from both established and emerging players. In the social media space, TikTok has emerged as a formidable rival to Facebook and Instagram. In e-commerce, Amazon faces competition from Walmart and Alibaba. In cloud computing, Amazon Web Services (AWS) faces competition from Microsoft Azure and Google Cloud Platform (GCP).

These companies will need to continue to innovate and differentiate their products and services to stay ahead of the competition. They will also need to be mindful of regulatory changes, as antitrust scrutiny is increasing in many countries.

Emerging Technologies

The FAANG companies will need to adapt to the rise of emerging technologies such as artificial intelligence (AI), augmented reality (AR), and virtual reality (VR). These technologies have the potential to disrupt many of the industries in which the FAANG companies operate.

For example, AI could be used to improve recommendation engines, personalize advertising, and automate customer service. AR and VR could be used to create new immersive experiences for consumers.

The FAANG companies that can successfully integrate these technologies into their products and services will be well-positioned for long-term growth.

Evolving Consumer Preferences

Consumer preferences are constantly evolving, and the FAANG companies will need to keep up. For example, consumers are increasingly concerned about data privacy and security. The FAANG companies will need to be transparent about how they collect, use, and protect consumer data.

Consumers are also becoming more discerning about the products and services they buy. They are demanding higher quality, better value, and more personalized experiences. The FAANG companies will need to meet these demands if they want to retain and attract customers.

In conclusion, the FAANG companies face a number of challenges in the years to come. They will need to adapt to increasing competition, embrace emerging technologies, and respond to evolving consumer preferences. However, with their strong track records of innovation and growth, the FAANG companies are well-positioned to continue to thrive in the years to come.

Here are some specific examples of how the FAANG companies are responding to these challenges:

- Facebook is investing heavily in AI to improve its ad targeting and recommendation engines.

- Amazon is developing new AR and VR experiences for its shopping platform.

- Apple is focusing on privacy and security, with features like App Tracking Transparency and Secure Enclave.

- Netflix is investing in original content to differentiate itself from competitors.

- Google is expanding its cloud computing business and developing new AI products.

Only time will tell how the FAANG companies will ultimately fare in the face of these challenges. However, one thing is for sure: they will need to continue to innovate and adapt if they want to maintain their position as some of the world’s most influential technology companies.