Profitable Facts About The Options Expiration Day (Trading The OPEX Day)

The options expiration week effect is well known but very little research can be found online about the specific options expiration day. Let’s dig a little deeper and find out some specifics (and profitable) about this day.

Has the option expiration day been good or bad for stocks?

What is the options expiration day?

US stock and index options expire on the Friday before the 3rd Saturday each month. Four times per year, on the last third Friday of the quarter, we have triple expiration days because of the expiry of futures contracts.

There are only three exceptions to the rule of the third Friday: Good Friday, Independence Day, and Christmas). When the third Friday is one of those three days, the expiry is on Thursday – the day before Friday.

Options expiration day – backtest no.1:

How does the options expiration day perform?

Trading Rules

[am4show have=’p2;p3;p58;p59;p130;p138;’ user_error=’Premium Post Access’ guest_error=’Premium Posts’]

The first test we do is to buy the close of the day before the options expiration day (Thursday) and sell on the close of the Friday, ie. we hold for one day.

[/am4show]

We use the S&P 500 as a proxy for stocks and test SPY from inception in 1993 until today.

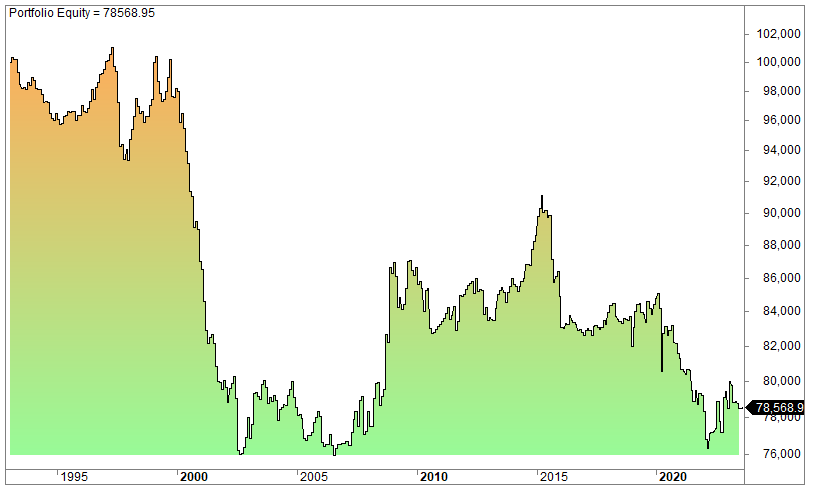

This is the equity curve (100 000 compounded):

The average gain is a negative 0.06%, and the win ratio is about 51%, in stark contrast to the positive tailwind of 0.04% on any random day over the same period. (The overnight trading strategies are a nice trading edge to employ in trading.)

Furthermore, it doesn’t help to differentiate between the months, either. It seems all months are weak except November. Perhaps that is because of the Thanksgiving effect?

That said, let’s buy the close the day before and sell the open on the OPEX day:

The average gain is 0.09%, much better than any random day.

Options expiration day – backtest no.2:

[am4show have=’p2;p3;p58;p59;p130;p138;’ user_error=’Premium Post Access’ guest_error=’Premium Posts’]

Does it improve if we add one or more variables (buying the close the day before OPEX and selling the close of OPEX)?

[/am4show]

No, from the long side, it doesn’t seem to work very well no matter what. The options expiration day seems to be an “impossible” day to make any money from the long side.

But what if we flip and short?

Options expiration day – backtest no.3: short

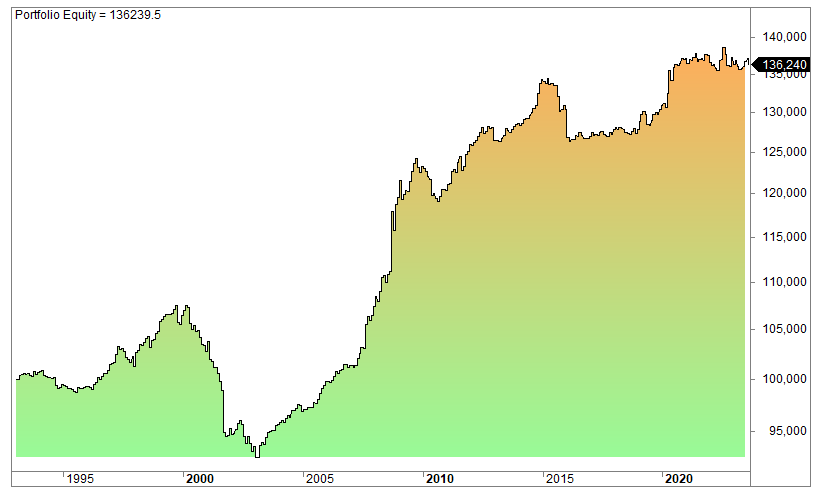

Short-selling is difficult but occasionally we are able to find some decent edges. Below is a short strategy that holds for one day:

The average gain is 0.18%, the win ratio is 56%, annual returns are 1.85%, and max drawdown is a modest 2.8%.

We believe this edge is so good and promising and thus we don’t want to reveal it but will save it to our paying subscribers for our monthly Trading Edges. Short trading strategies are rare!

Amibroker code for options expiration day:

If you’d like to have the Amibroker code for the options expiration day, you can order it here and at the same time get access to the code of 200+ of the other free trading and investment strategies we have made over the years. The great majority of the strategies have additional code for Tradestation and Easy Language.

The options expiration day – conclusions:

Our backtests suggest that the options expiration day (OPEX) is a very bad day (long) despite the fact that the week itself normally is very good. As we showed in one of the equity curves above, it looks likely it’s possible to develop tradable short strategies.

Relevant articles:

- Seasonal trading strategies

- The holiday effect in stock markets

- The options expiration week effect

- Trading the week after options expiration day

- Trading the futures expiration week in DAX 40 and Euro Stoxx 50

- Trading the futures expiration week in Euro Bonds (FGBL)

- Trading the week after futures expiration in DAX 40

- Trading the week after futures expiration in Euro Stoxx 50

- Trading the week after futures expiration in Euro Bund