How I Made A Profitable Chaikin Oscillator Trading Strategy In Python

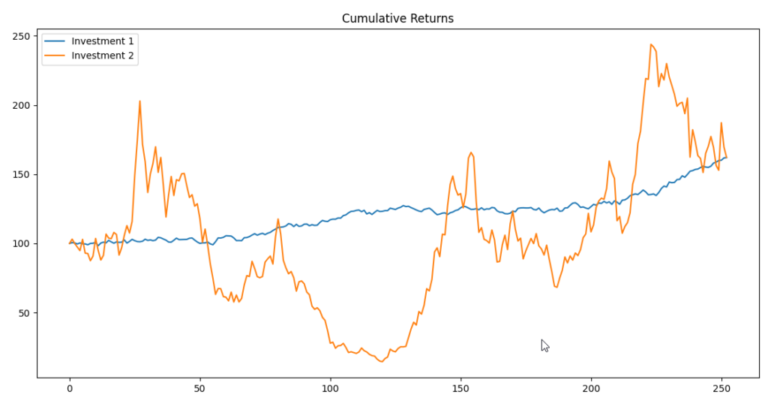

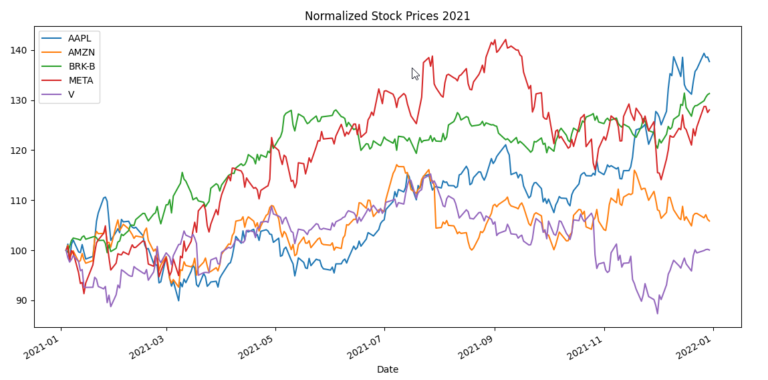

Introduction This tutorial will implement the Chaikin Oscillator in Python using historical financial data from the iShares Russell 1000 Growth ETF (IWF). The first part will briefly review the theory behind this indicator. The second part will code a trading strategy using this indicator in Python. Related reading: – Many more Python trading strategies Chaikin…