How I Made a Profitable Ichimoku Cloud Strategy Using Python

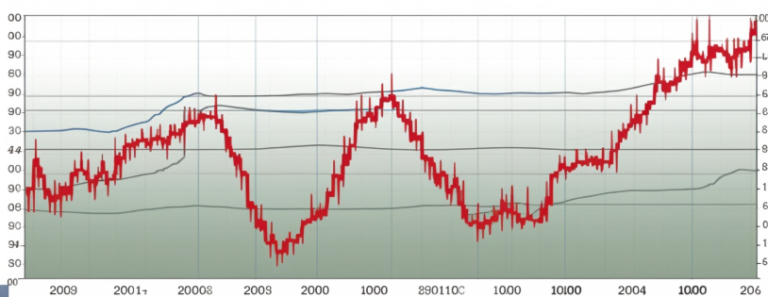

Introduction This tutorial will explain the Ichimoku Cloud indicator, and it will implement a trading example in Python using data from the iShares Core US Aggregate Bond ETF (AGG) and the Energy Select Sector SPDR Fund (XLE). Along the way, you will learn how to use the mplfinance Python package to generate candle charts. The…