Is September Always Bad For Stocks?(Insights)

September is known for being the worst month of the year for stocks.

But is it always like this?

We ran some backtests:

[am4show have=’p2;p3;p58;p59;p130;p138;’ user_error=’Premium Post Access’ guest_error=’Premium Posts’]

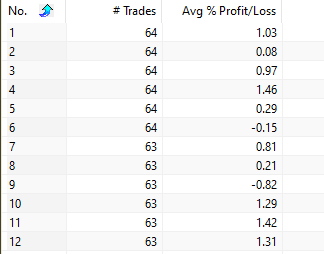

First, let’s backtest the performance of all months since 1960:

The first column shows the month, and it’s pretty obvious that September is the worst, with a negative average gain of 0.82%.

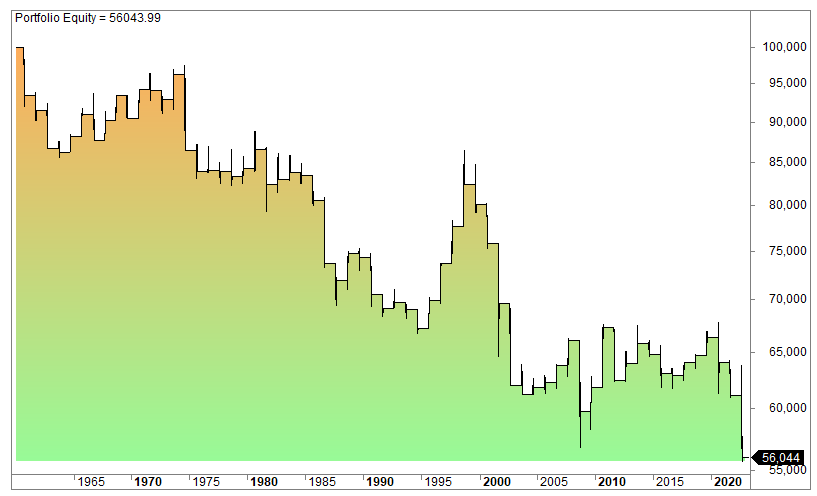

September is pretty consistently bad:

The win rate is 44%.

But what happens if the gain in the corresponding year is positive or negative?

Let’s find out:

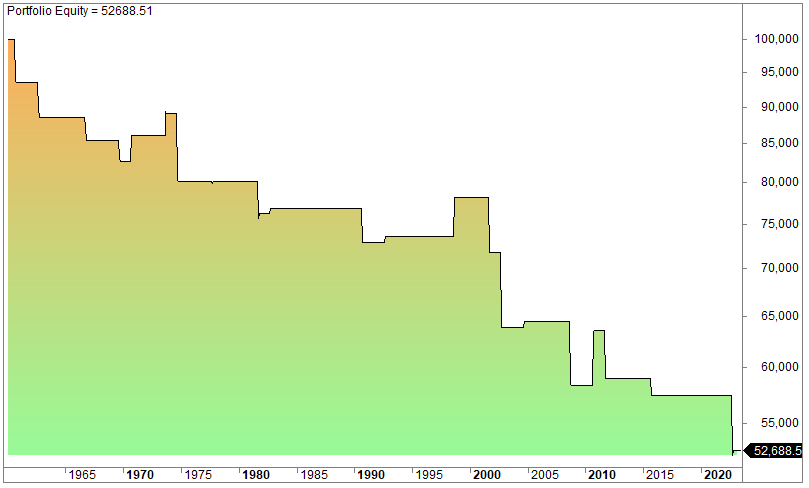

This is the equity curve if the gains leading up to September are negative:

A whopping negative 2.86% and only 33% winners (which are small).

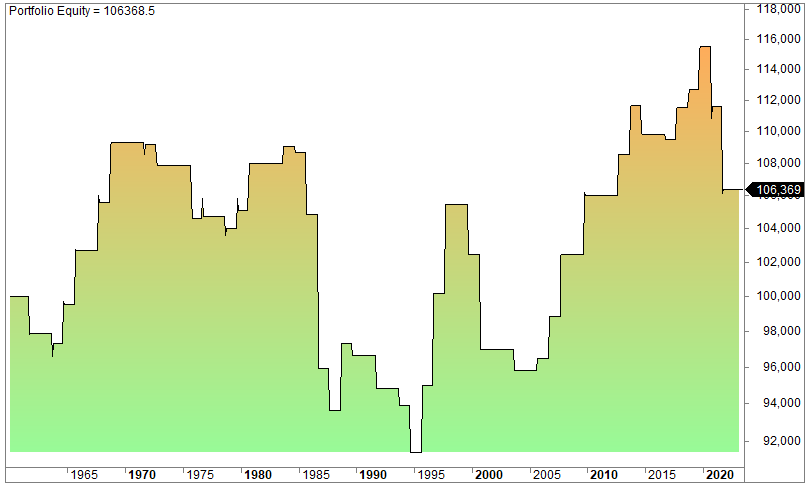

If the gains leading up to September are positive, it looks like this:

Still not great, but at least the worst losses are filtered out: a positive 0.2% gain and 50% winners.

[/am4show]

Disclaimer

Quantified Strategies (SIA Lofjord) is not an investment advisor. The content and information provided are educational and should not be treated as financial advisory services or investment advice. Trading and investment in securities involve substantial risk of loss and is not recommended for anyone that is not a trained trader or investor – it shall be conducted at your own risk. It is recommended that you never risk more than you are willing to lose. Leverage can lead to substantial losses. Any use of leverage, margin, or shorting is at your discretion. Quantified Strategies (SIA Lofjord) is not responsible for any losses that occur as a result of its content and information.

Hypothetical or simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, Since the trades have not been executed, the results may have under or overcompensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs, in general, are also subject to the fact that they are designed with the benefit of hindsight. No representations are made that any account will or is likely to achieve profit or losses similar to those shown.

FAQ:

Why is September often considered a challenging month for stocks?

Several factors contribute to the perception of September as a challenging month for stocks. One reason is the return of traders and investors from summer vacations, leading to increased trading volumes and potential market fluctuations. Historically, September has been considered a challenging month for stocks. It’s often associated with increased market volatility and, in some cases, market downturns.

Does poor stock performance in September happen every year?

No, poor stock performance in September is not a guaranteed occurrence every year. While historical patterns suggest challenges in this month, the stock market’s behavior can be influenced by various unpredictable factors. Certain sectors, such as technology and consumer discretionary, have historically shown sensitivity to September’s market dynamics.

Are there specific events or factors that make September challenging for stocks?

September is often marked by events that can impact the stock market, such as economic data releases, geopolitical events, and uncertainties surrounding government policies. Additionally, it is the month when many companies provide updates on their performance.