Collapse In Utilities – What Happens Next? (Member Article)

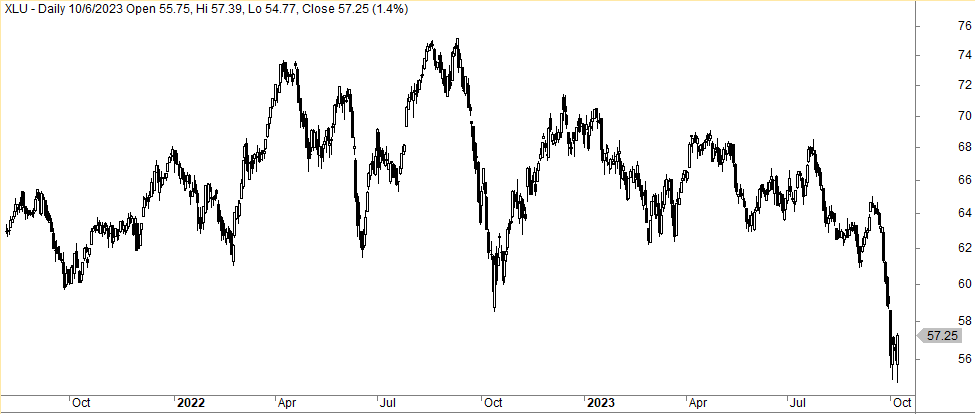

The utility sector has taken a major hit over the last couple of weeks. Below is XLU, the ETF that tracks the sector:

But as you can see, it’s not the first time it has “collapsed”, but it has caught the headlines. However, it was even worse in October 2022.

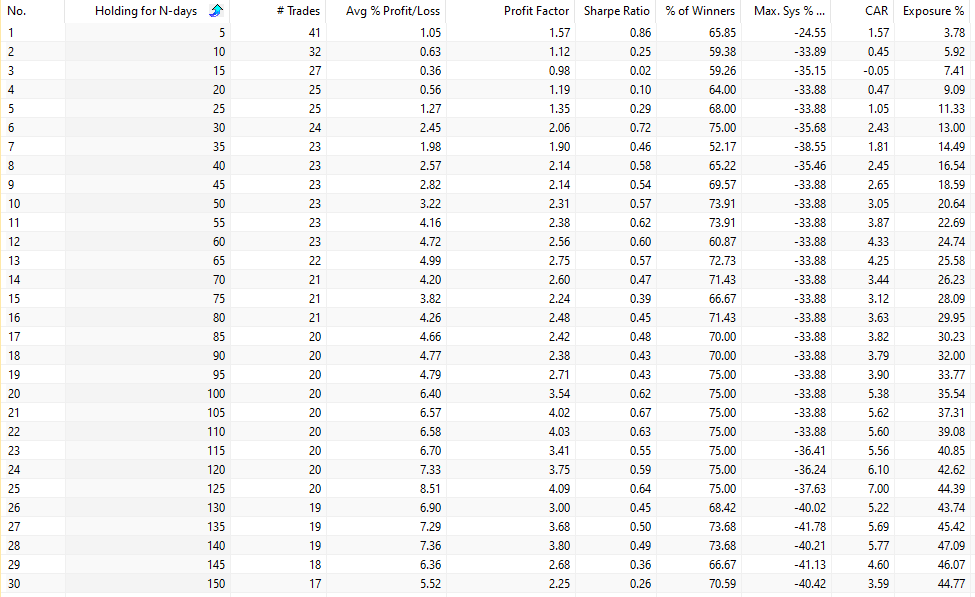

Let’s look at what happens with returns when the 15-day RSI is below 30 (which is the case now) and we hold for N-days:

The second column shows the number of days we hold XLU after the 15-day RSI has reached 30. For comparison, buy and hold has returned about 7.5% with dividends reinvested (since 2002). The column CAR is the annual returns.

Trading Rules

[am4show have=’p2;p3;p58;p59;p130;p138;’ user_error=’Premium Post Access’ guest_error=’Premium Posts’]

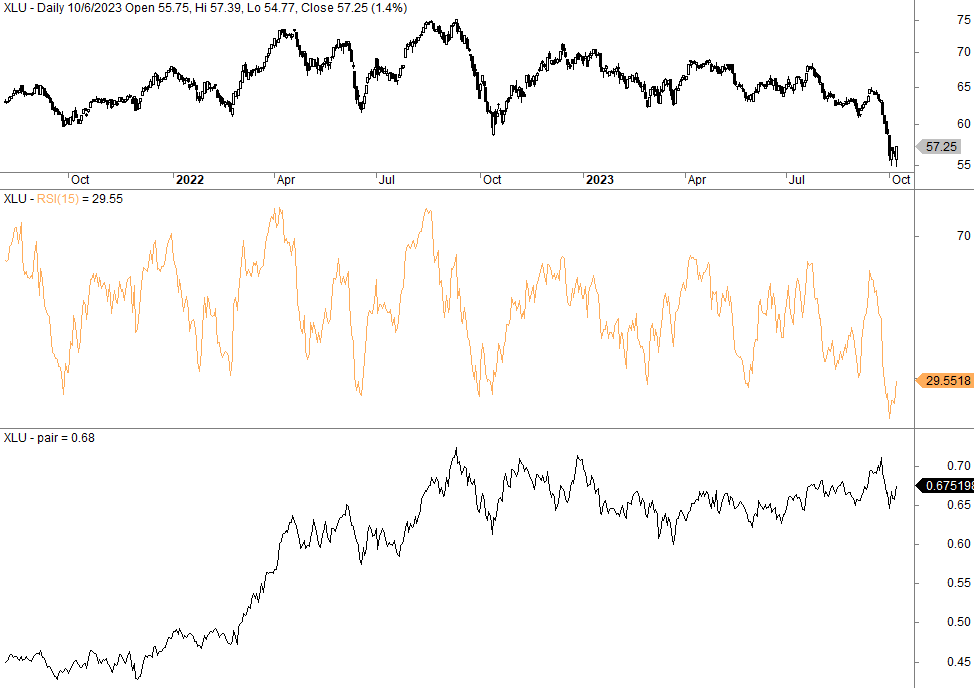

However, XLU and utility stocks are heavily dependent on interest rates, and rates have risen. If we adjust for that, XLU’s drop is not that big. The lower pane shows the XLU/TLT ratio:

Let’s make a simple trading strategy:

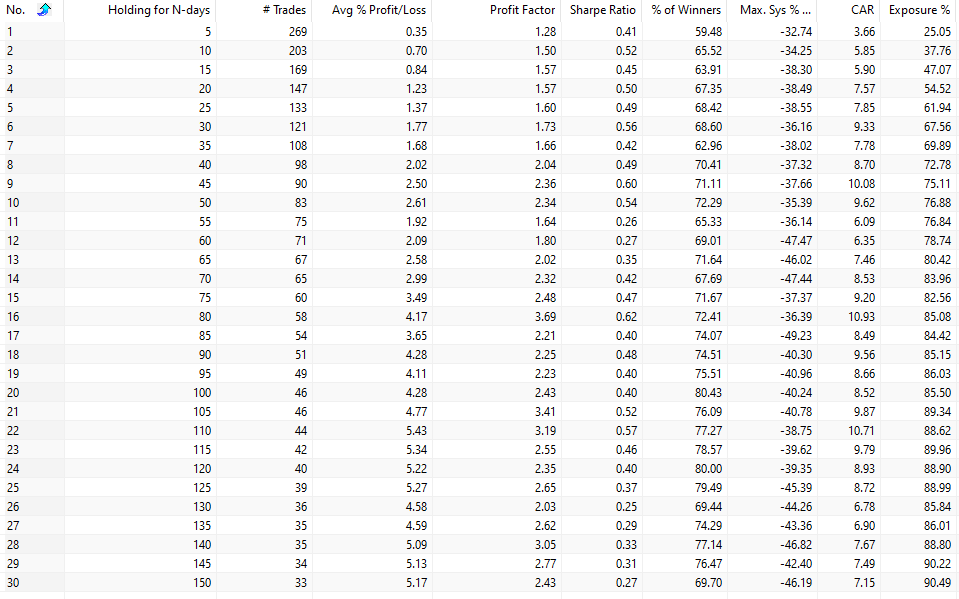

When the 5-day RSI of the XLU/TLT ratio drops below 30, we go long XLU and we hold for N-days:

[/am4show]

The second column shows the result if we hold for N-days. The second last column (“CAR”) shows the annual returns. As you can see, the returns are decent compared to buy and hold.