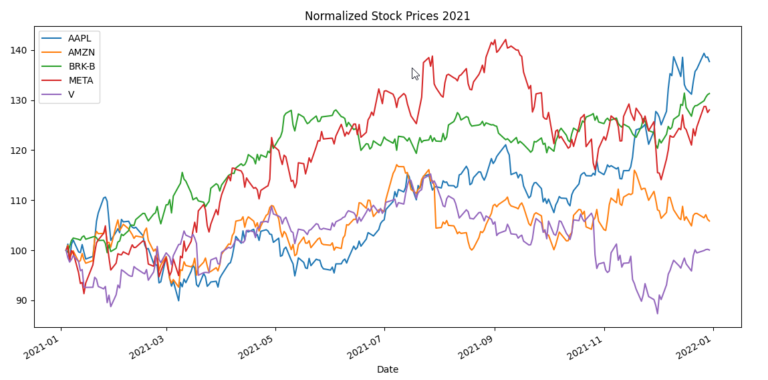

Best Python Libraries For Algorithmic Trading (Examples)

Libraries are an essential part of Python that makes programming faster and easier for developers. These two qualities are especially relevant in Algorithmic Trading. That’s why, in this article, we will explore some of the best algorithmic trading libraries in Python, including those to download data, manipulate data, perform technical analysis, and backtest trading strategies….