Weekend Gold Strategy | An Overview

Gold has historically had a weekend effect. Is the edge big enough to be profitable?

Trading Rules

[am4show have=’p2;p3;p58;p59;p130;p138;’ user_error=’Premium Post Access’ guest_error=’Premium Posts’]

Let’s test the performance of owning gold/GLD from the close of every Thursday until the open on Monday:

- If today is Thursday, then buy at the close;

- Sell on Monday’s open

[/am4show]

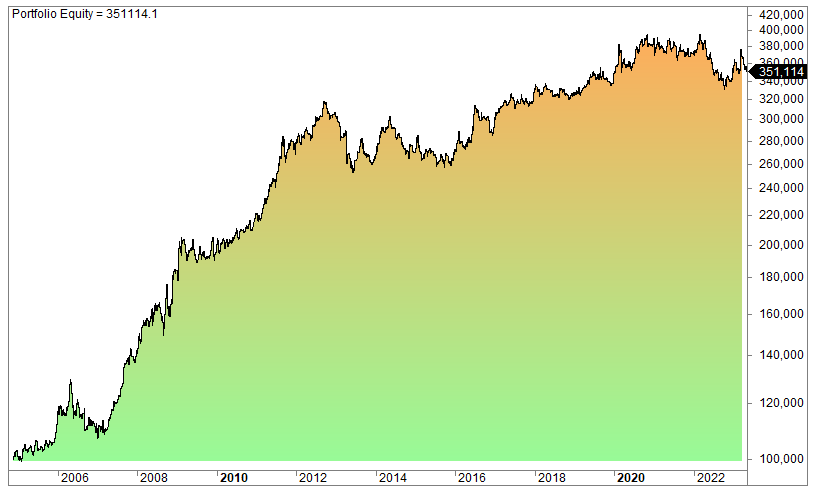

If we backtest the strategy on GLD, we get the following equity curve:

The edge has vanished over the years.

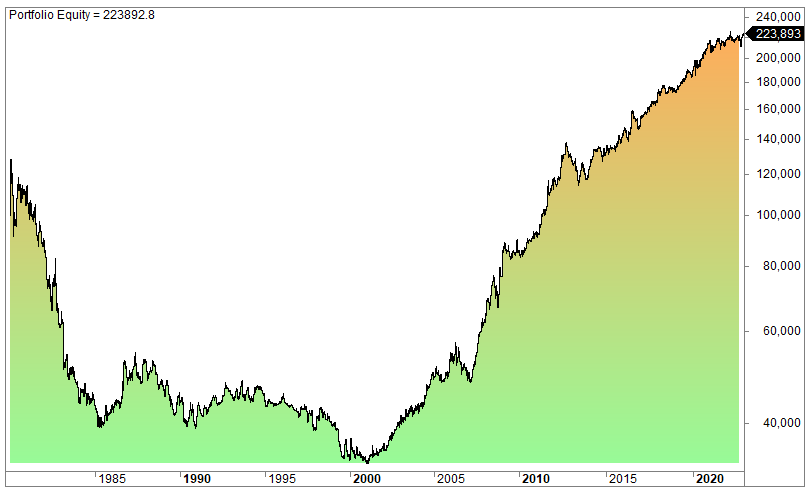

If we zoom out and backtest the gold spot price from 1980, we can see that the edge didn’t exist at all until the 2000s:

Disclaimer

Quantified Strategies (SIA Lofjord) is not an investment advisor. The content and information provided are educational and should not be treated as financial advisory services or investment advice. Trading and investment in securities involve substantial risk of loss and is not recommended for anyone that is not a trained trader or investor – it shall be conducted at your own risk. It is recommended that you never risk more than you are willing to lose. Leverage can lead to substantial losses. Any use of leverage, margin, or shorting is at your discretion. Quantified Strategies (SIA Lofjord) is not responsible for any losses that occur as a result of its content and information. Always use a demo account for many months before you try live trading. Trading requires hard and systematic work – there is no easy money.

Hypothetical or simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Commissions and slippage are not included. Also, Since the trades have not been executed, the results may have under or overcompensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs, in general, are also subject to the fact that they are designed with the benefit of hindsight. No representations are made that any account will or is likely to achieve profit or losses similar to those shown.

FAQ:

How does the Weekend Gold Trading Strategy differ from weekday strategies?

Weekend trading allows investors to react to global events and market news that might impact gold prices before the traditional markets reopen. The weekend strategy may involve analyzing geopolitical events, economic indicators, and news specific to the weekend timeframe, as traditional market factors may not be as influential.

What factors should I consider when implementing a Weekend Gold Trading Strategy?

Factors include global economic data, geopolitical events, and any market-moving news over the weekend. Additionally, be aware of potential liquidity issues during non-traditional trading hours. Weekend gold trading is typically available on some platforms during specific hours, often starting on Friday evening and closing on Sunday. It’s crucial to check the platform’s trading hours.

Can I use technical analysis for weekend gold trading?

Yes, technical analysis tools such as charts and indicators can still be valuable during weekend trading. However, keep in mind that market movements might be influenced by fewer participants. Look out for major economic releases, geopolitical developments, and any unexpected news that could impact global markets, as these can influence gold prices during the weekend.