The Internal Bar Strength (IBS) Indicator [Trading Strategies, Rules + Video]

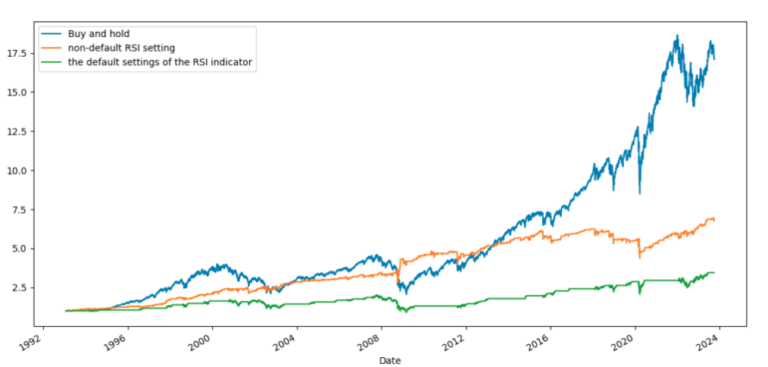

The Internal Bar Strength indicator (IBS) has worked remarkably well for over two decades. We can only guess why, but the stock market has been highly mean-reverting during this period, and this has, of course, given the IBS a nice tailwind. IBS is simply an indicator where you buy on weakness and sell on strength,…