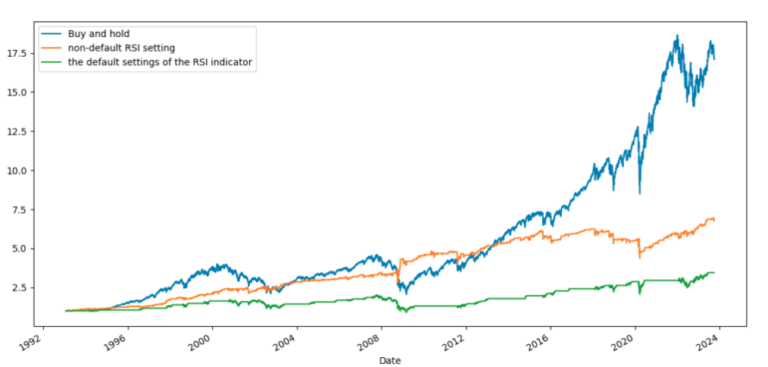

I Backtested The Default Settings Of The RSI Indicator And Made It Better (Strategy)

The Relative Strength Index indicator is popular, for a reason, but in this article, I backtested the default settings of the RSI indicator, and made it better. Investments and trading is a wonderful world where large companies and small investors can participate from the comfort of their homes. You only need a device with internet…